SEC Fines Chicago Firm $1.5 Million for Failing to Submit Suspicious Activity Reports

The Securities and Trade Rate (SEC) retains trying to get ways to expand the reach of its enforcement powers. On Tuesday, the company announced costs in opposition to Archipelago Purchasing and selling Providers Inc. (ATSI), a Chicago-essentially based broker-dealer.

The company needed to mediate procuring and selling extra closely, the regulators mediate. Many of of stories of suspicious activity stories (SARs) ought to had been drawing shut from 2012 to 2020.

ATSI Ignored Its Responsibility to File Suspicious Activity Experiences

Per the SEC, ATSI failed to file a minimal of 461 Suspicious Activity Experiences (SARs) associated to over-the-counter (OTC) securities trades carried out on ATSI’s different procuring and selling gadget Worldwide OTC.

The unfiled SARs enthusiastic mostly microcap and penny stock securities, which the SEC considers uncertain investments.

Namely, ATSI’s sole enterprise is operating Worldwide OTC, an different procuring and selling gadget aged by broker-sellers to change OTC stocks.

Even when hundreds of day-to-day trades in uncertain microcap and penny stocks befell on Worldwide OTC, ATSI didn’t put an anti-money laundering surveillance program till September 2020, the SEC acknowledged.

This failure violates Allotment 17(a) of the Securities Trade Act and Rule 17a-8, which require broker-sellers to file SARs on questionable transactions.

Therefore, ATSI allegedly failed to detect and listing skill manipulative and suspicious procuring and selling activities. These consist of activities indulge in spoofing, layering, wash procuring and selling, and pre-organized procuring and selling.

To determine on the costs, ATSI agreed to pay a $1.5 million penalty, with out admitting or denying the SEC’s findings.

Submitting SARs Is a Factual Need to

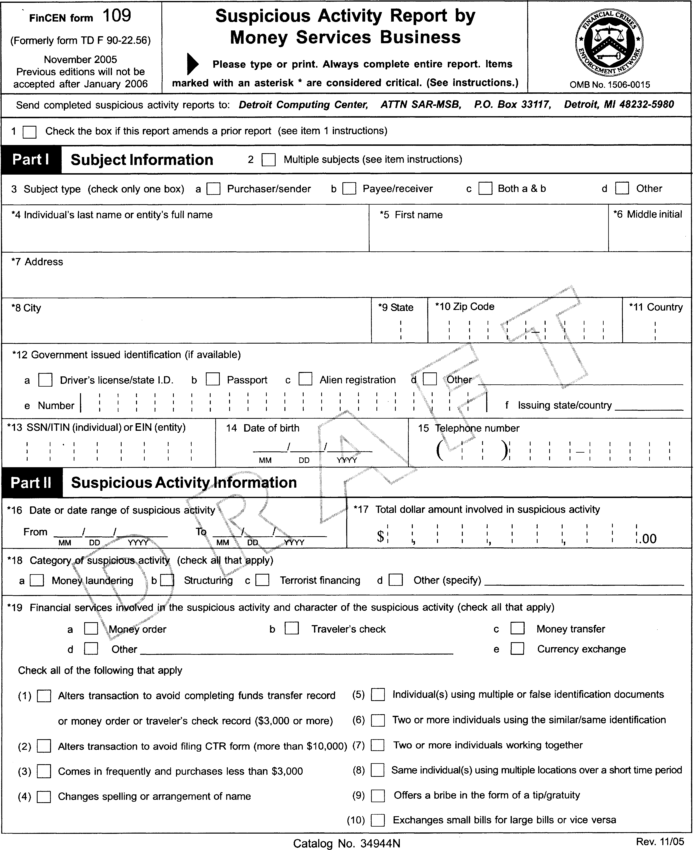

Within the United States, Suspicious Activity Experiences (SARs) are paperwork that monetary institutions utilize to alert authorities to potentially illegal transactions. SARs first came on the scene in 1970, as allotment of the Monetary institution Secrecy Act (BSA). Their utilize helps terminate money laundering, terrorist financing, and other monetary crimes.

A compliance and surveillance department would possibly per chance per chance fair also be a foremost burden for a enterprise to withhold. Nonetheless submitting SARs is a fair requirement all the an identical.

“All SEC-registered broker-sellers need to follow the Monetary institution Secrecy Act, including submitting SARs,” acknowledged Daniel R. Gregus, Director of the SEC’s Chicago Regional Situation of enterprise, in an SEC observation.

“When companies indulge in ATSI fail to investigate crimson flags, seriously in bigger-possibility microcap and penny stocks, they expose investors to needless dangers.”

Monetary institutions and regulators utilize SARs all the contrivance in which by the enviornment to relief detect monetary crimes. In most jurisdictions, sending a SAR is apparent from making a criminal criticism. Authorities will review the listing and judge whether or not a paunchy investigation is required.

Within the United States, companies need to ship SARs to the Monetary Crimes Enforcement Network (FinCEN).

For extra info about submitting SARs, discuss over with the FinCEN reliable web do right here.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is committed to unbiased, transparent reporting. This news article goals to assemble fair, well timed recordsdata. Nonetheless, readers are suggested to verify info independently and discuss over with a reliable sooner than making any choices in step with this deliver.