Grayscale Bitcoin ETF Decision Sparks Mixed Reactions From Crypto Influencers

Amid a most unique court docket ruling mandating the SEC to re-overview Grayscale’s Bitcoin ETF proposal, world crypto influencers are actively speculating about the chance of approval and its doubtless impact on Bitcoin’s trace.

As various influencers utter it a recreation-changer, others level to a come future with a six-resolve Bitcoin trace.

Grayscale Bitcoin ETF: Mark, Timeline and Uncertainties

Crypto influencers worldwide are predicting what the long bustle holds for Bitcoin after the court docket ordered that the United States Securities and Alternate Price’s (SEC) possibility to disclaim Grayscale Investments’ Bitcoin ETF product modified into no longer authentic and will likely be reassessed.

Following the August 29 court docket ruling, various crypto influencers made posts on X (previously recognized as Twitter).

Miles Deutscher instructed his 356,000 followers that it modified into a recreation-changer. “This changes all the pieces. Time to listen again,” Deutscher states.

Deutscher predicts that this now ability the odds of other Bitcoin house approvals possess “vastly elevated.”

Ivan on Tech declared to his 400,000 followers he is confident the product will likely be licensed and hints in direction of a six-resolve Bitcoin trace in the come future:

“Grayscale crushes SEC. ETF Inevitable. Bitcoin $100,000 LFG,” he remarks.

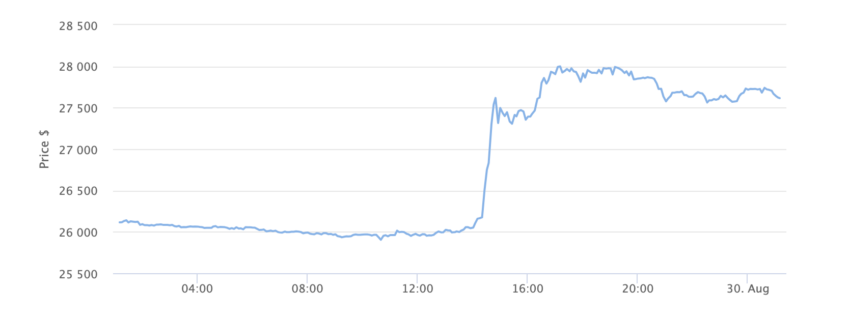

Following the ruling, Bitcoin skilled a trace reach of roughly 7.2%, reaching a height of $28,000. As of the time of writing, Bitcoin’s most unique trace is $27,592.

Host of the Bankless Display, Ryan Sean Adams, described the most unique ruling as “mammoth news.” He even believes it will likely be as early as this year that it sees approval. “Resume the bull,” he states.

This ends in hypothesis about the long bustle of Ark Invest’s Bitcoin ETF product. The SEC has repeatedly postponed providing an . Contemporary reviews imply that the SEC may perhaps per chance perhaps doubtlessly lengthen that chop-off date till January 2024.

No longer too long ago, Cathie Wood, the CEO of Ark Invest, speculated that if the SEC were to approve Bitcoin ETFs, it would originate so in a single possibility. “I contain if the SEC goes to approve a Bitcoin ETF, this can approve extra than one straight away,” she proclaims.

Capability Change Objections

Nonetheless, Bloomberg’s James Seyffart outlines two ways that the SEC can peaceful stop Bitcoin ETFs from checklist.

In a post to his 32,000 followers, he states that the SEC would must “revoke the checklist of Bitcoin Futures ETFs.”

He explains that the most most unique submitting states that the SEC “can’t argue about manipulation of markets whereas allowing Bitcoin Futures ETFs.”

Nonetheless, he considers this enviornment to be no longer likely. He believes it’s extra doubtless that the SEC can also elevate unique reasons for denial that haven’t been presented sooner than:

“I truly were announcing for months it may perhaps well per chance perhaps must originate with Custody or settlement of Bitcoin which is rarely any longer one thing that futures ETFs must fear about. SEC has made rather a couple of noise spherical custodians.”

Disclaimer

In adherence to the Have faith Venture guidelines, BeInCrypto is dedicated to just, transparent reporting. This news article goals to present precise, well timed data. Nonetheless, readers are instructed to study info independently and search the suggestion of with a legit sooner than making any choices in response to this assert material.