Economic Report: 14 million mortgages were refinanced during ‘pandemic boom.’ That makes life very difficult for home buyers.

The enormous pandemic mortgage refinance development is most surely over, nonetheless the aftershock is collected rippling via the housing market. Owners are maintaining up dwelling gross sales, as their ultra-low prize is too treasured to present up.

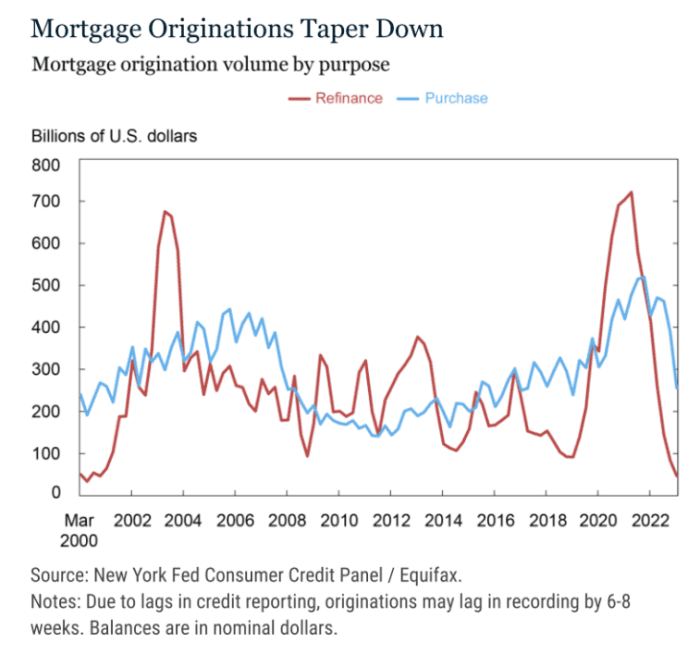

All the plot via the early days of coronavirus pandemic in 2020 and 2021, mortgage charges fell sharply, and thousands and thousands of owners jumped at the different to refinance. The 30-twelve months mortgage fell all the style down to 2.65% in early January of 2021, in line with Freddie Mac recordsdata

FMCC,

The Federal Reserve Monetary institution of Novel York estimated that 14 million mortgages were refinanced finally of the “pandemic refinancing development.”

The surge in refinancing used to be, in fragment, because of strong household steadiness sheets and an increased want for housing, the Novel York Fed said in a blog submit printed Monday.

The in style dwelling owner who refinanced saw their month-to-month price tumble by $220, the Fed said.

The largest fragment of mortgages that were refinanced originated from 2015 onwards, the NY Fed. said. Older mortgages, similar to these originated earlier than 2010, were the least likely to be refinanced.

Owners probably to refinance their mortgage owed a steadiness of $400,000 to $500,000 on their mortgage, the NY Fed concluded.

“The mortgage refinancing development is over, nonetheless its impact will likely be seen for decades to close encourage,” Andrew Haughwout, director of household and public policy compare at the NY Fed, said in a commentary.

Extremely-low charges win squeezed housing stock

Undoubtedly one of the most largest consequences of the refinancing development is that might-be homebuyers this day are truly struggling to search out properties for sale.

“The close of the most fresh exceptionally low hobby-payment duration leaves householders a diminutive bit disincentivized to sell or swap properties,” the NY Fed authors successfully-known.

In other words, householders aren’t serious about giving up their ultra-low mortgage payment and selling their dwelling. No longer handiest are charges far bigger this day, with the 30-twelve months above 6%, nonetheless dwelling prices win continued to preserve elevated.

Novel listings — what number of sellers were inserting up their properties for sale — were down by 16% in early Would possibly per chance per chance in contrast to a twelve months ago, in line with Realtor.com.

(Realtor.com is operated by Facts Corp

NWSA,

subsidiary Cross Inc., and MarketWatch is a unit of Dow Jones, additionally a subsidiary of Facts Corp.)

“Owners now taking a look to drag will face increased borrowing costs and larger prices, with fresh dwelling prices being extra than 36% bigger than they’d been pre-pandemic,” the NY Fed said.

Owners seem reluctant to sell. Gross sales of previously-owned properties fell 22% twelve months-over-twelve months in March, in line with the Nationwide Association of Realtors. Novel recordsdata on April dwelling gross sales will likely be launched this week.

Many patrons are turning to new builds to search out appropriate housing alternate choices. Novel dwelling gross sales jumped 9.6% in March. One-third of housing stock is new building, a deviation from the historical norm of fresh properties being trusty 10% of general housing, the Nationwide Association of Home Builders said in April.

And for the mortgage enterprise, enterprise is likely to be far slower than it used to be finally of the pandemic as fewer householders are refinancing. The NY Fed said mortgage originations — which encompass refinanced mortgages — fell sharply within the foremost quarter of 2023 to $324 billion, the lowest stage since 2014

It’s now not tense to sign why few are attracted to refis: The 30-twelve months used to be averaging at 6.35% in mid-Would possibly per chance per chance, as in contrast to 5.3% a twelve months ago, in line with recordsdata from Freddie Mac.

The upward push in charges between December 2020 and October 2022 used to be now not trusty steep, it used to be historical: Charges rose from 2.68% in 2020 to 6.9% in 2022, a really mighty swing since the early Eighties, the NY Fed said, citing recordsdata from Freddie Mac.