Why Ethereum (ETH) Price Is Likely to Consolidate Between $3,000 and $3,200 in Early 2026

With the Bitcoin designate hovering inner a staunch vary, the Ethereum designate is also displaying a same trend. For over few weeks, the designate has been shopping and selling conclude to the $3000 mark, leaving merchants doubtful referring to the following major pass. Even supposing the region market has been affirming calmness, the spinoff markets are making ready to amplify the volatility. The alternatives data imply merchants aren’t positioning for a straight away breakout or breakdown, which hints in direction of an extended consolidation inner the hot vary.

Now the query arises-When will the ETH designate crash out from the structure between $3000 and $3200?

The Market Is Gearing up for Later, But No longer for Now

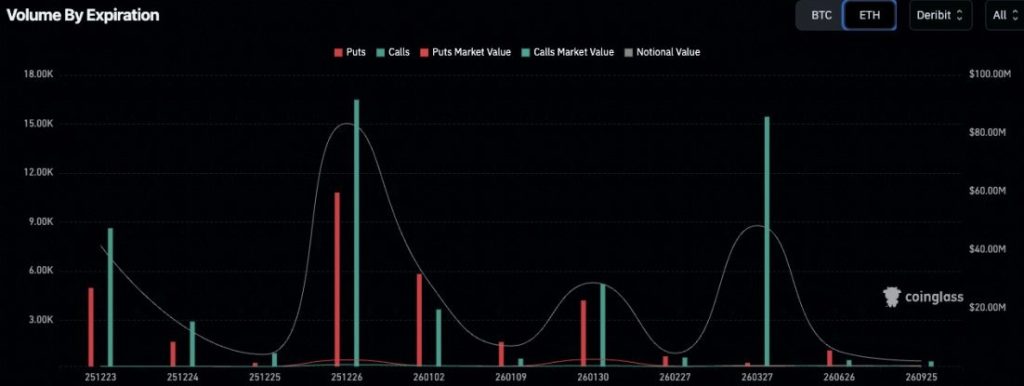

Ethereum alternatives process is increasingly more concentrated in leisurely-2025 and 2026 expiries, while rapid-dated contracts remain comparatively unruffled. This shift in most cases signals rollover behavior, the put merchants lengthen exposure in notify of betting on quick designate moves.

Historically, same patterns possess appeared throughout intervals of market uncertainty, comparable to mid-2023 and early 2024, when ETH spent weeks consolidating earlier than trending later.

Recent alternatives data exhibits a undeniable amplify in process in leisurely-2025 and 2026 expiries, while diagram-time-frame contracts remain comparatively mild. This in most cases signifies rollover process comparatively than fresh non eternal bets. When merchants seek data from a intriguing designate pass, ask for temporary-dated alternatives veritably rises. That is now not taking place with the Ethereum designate lawful now.

This positioning suggests merchants are cosy preserving exposure for the longer time-frame but gaze minute urgency in the diagram future. In simple terms, the market is making ready for later, now not for now.

Strike Put Files System to a Defined Buying and selling Fluctuate

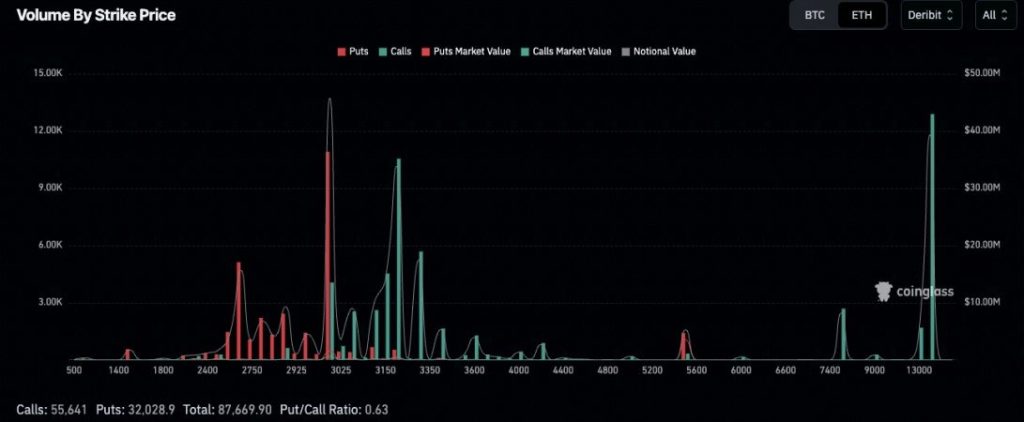

The distribution of alternatives by strike designate provides more context. Most name hobby is concentrated between $3,000 and $3,300, while set positioning remains modest. The hot set-to-name ratio of spherical 0.63 exhibits a bullish bias, but now not coarse optimism.

Thanks to this positioning, the $3,000–$3,200 zone has changed into a pure shopping and selling vary. The $3,000 level acts as a psychological give a enhance to and a major alternatives strike, while $3,200 marks the home the put name hobby starts to thin. This creates a “pinning” cease, the put designate tends to preserve trapped between these phases except fresh ask enters the market.

What Would possibly well maybe well Damage Ethereum Put Out of This Fluctuate?

Ethereum is for the time being compressing between rising give a enhance to diagram $2,900 and resistance spherical $3,200–$3,250. This designate structure suggests tension is constructing, now not that the trend has already changed. A bullish breakout requires ETH to reclaim $3,200 and preserve above it with robust region quantity.

The ETH designate has been affirming an ascending structure since mid-November and bouncing off the ascending give a enhance to. Bears had been restricting the rally below $3000 for a pair of days, while the quantity has dropped particularly. The amount compression in most cases results in a stronger breakout, and if this materialises, a upward push to $3,200 could well also very successfully be imminent. Alternatively, breaking out from the resistance zone between $3225 and $3300 could well also require more making an strive to search out quantity.

Conclusion

Ethereum is now not stuck—it’s being deliberately positioned. Choices merchants are pushing possibility into 2026, signalling self perception in elevated prices later, but small urgency lawful now. That positioning aligns with the hot designate behaviour, the put ETH continues to respect the $3,000 floor while failing to entice note-by above $3,200. Until rapid-dated alternatives process and region quantity return, the ETH designate is more more seemingly to alter sideways than trend aggressively.

FAQs

Is Ethereum more seemingly to trend immediately or preserve sideways?

Ethereum is more more seemingly to alter sideways for now, as quantity compression and longer-time-frame positioning imply a delayed pass.

How extra special will Ethereum be in 2026?

Traders focusing on 2026 seek data from ETH could well also reach $5,000–$6,000 if adoption and network process develop gradually.

How extra special will 1 Ethereum be price in 2030?

Long-time-frame, ETH could well also hit $8,000–$10,000 by 2030 if DeFi, NFTs, and institutional adoption preserve accelerating.

Will ETH ever hit $10,000?

Sure, ETH could well also reach $10,000 in a bullish grief, but it completely would seemingly require breaking $6,000–$7,000 first and robust market momentum.

Belief with CoinPedia:

CoinPedia has been delivering factual and successfully timed cryptocurrency and blockchain updates since 2017. All state material is created by our knowledgeable panel of analysts and journalists, following strict Editorial Guidelines primarily based utterly mostly on E-E-A-T (Skills, Skills, Authoritativeness, Trustworthiness). Each article is truth-checked against revered sources to make sure accuracy, transparency, and reliability. Our overview protection ensures self sustaining stories when recommending exchanges, platforms, or instruments. We strive to offer successfully timed updates about the total lot crypto & blockchain, lawful from startups to alter majors.

Investment Disclaimer:

All opinions and insights shared listing the author’s derive views on fresh market conditions. Please construct your derive learn earlier than making investment choices. Neither the author nor the newsletter assumes accountability for your monetary picks.

Sponsored and Adverts:

Sponsored state material and affiliate hyperlinks could well also unbiased appear on our diagram. Adverts are marked clearly, and our editorial state material remains utterly honest from our ad companions.