USD/JPY Price Forecast: Testing consolidation breakout near 158.00

The USD/JPY pair trades 0.18% decrease to shut 158.35 at some level of the early European shopping and selling session on Friday. The pair has attain under stress because the Japanese Yen (JPY) strengthens on verbal warnings of intervention by Japan to counter one-formulation excessive moves.

Japanese Yen Heed This present day

The table under shows the share trade of Japanese Yen (JPY) in opposition to listed fundamental currencies recently. Japanese Yen changed into once the strongest in opposition to the US Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | -0.05% | -0.16% | -0.05% | -0.08% | -0.33% | -0.13% | |

| EUR | 0.03% | -0.02% | -0.13% | -0.02% | -0.04% | -0.29% | -0.09% | |

| GBP | 0.05% | 0.02% | -0.11% | 0.00% | -0.02% | -0.27% | -0.07% | |

| JPY | 0.16% | 0.13% | 0.11% | 0.13% | 0.08% | -0.17% | 0.03% | |

| CAD | 0.05% | 0.02% | -0.01% | -0.13% | -0.05% | -0.30% | -0.09% | |

| AUD | 0.08% | 0.04% | 0.02% | -0.08% | 0.05% | -0.25% | -0.04% | |

| NZD | 0.33% | 0.29% | 0.27% | 0.17% | 0.30% | 0.25% | 0.20% | |

| CHF | 0.13% | 0.09% | 0.07% | -0.03% | 0.09% | 0.04% | -0.20% |

The warmth device shows share adjustments of fundamental currencies in opposition to every diverse. The unhealthy currency is picked from the left column, while the quote currency is picked from the tip row. As an illustration, if you happen to opt the Japanese Yen from the left column and jog alongside the horizontal line to the US Greenback, the share trade displayed within the field will picture JPY (unhealthy)/USD (quote).

Earlier within the day, Japan’s Finance Minister (FM) Satsuki Katayama said that every alternatives, including assert currency intervention, will be found in for facing the present weak point within the JPY.

Early this week, United States (US) Treasury Secretary Scott Bessent furthermore said that Japan wants sound formula and verbal substitute of financial coverage, after meeting with Japanese Finance Minister Satsuki Katayama.

Nonetheless, the broader outlook of the JPY stays hazardous as investors seek data from Japan to coach looser fiscal coverage this year to stimulate economic boost.

Meanwhile, the US Greenback (USD) ticks down earlier than an prolonged weekend within the US, however is broadly firm because the Federal Reserve (Fed) is predicted to raise pastime charges regular within the coverage meeting later this month.

USD/JPY technical diagnosis

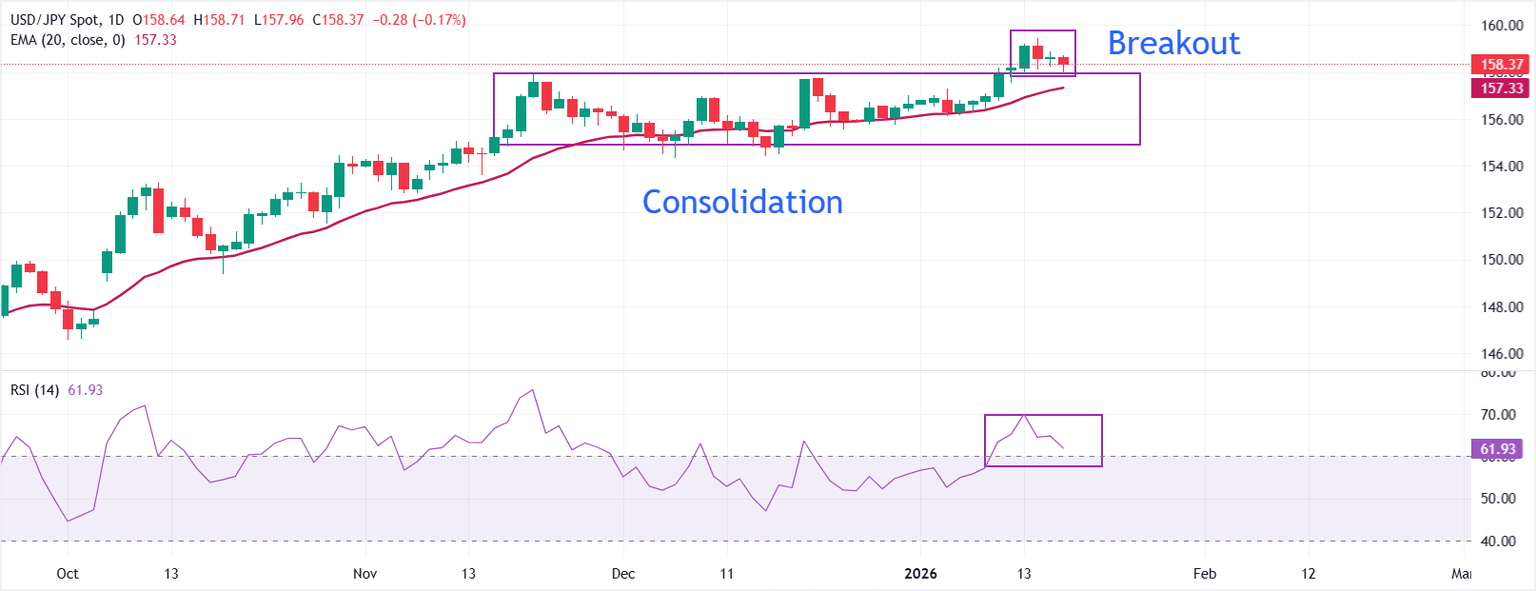

USD/JPY corrects on Friday to shut 158.00, attempting out the breakout location of the consolidation fashioned within the vary between 154.40 and 157.90 within the closing two months.

Heed holds above the rising 20-day Exponential Shifting Realistic (EMA) at 157.33, preserving the near-time duration uptrend intact. The 20-day EMA’s regular upslope underscores sustained shopping stress.

The 14-day Relative Strength Index (RSI) at 62 (bullish) after easing from an overbought discovering out helps pattern continuation as momentum normalizes.

While above the 20-day EMA, the pair would stay biased elevated, with pullbacks expected to be supported at that transferring moderate. RSI near 62 leaves room for extra upside earlier than overbought prerequisites re-emerge. A day to day shut under 157.33 would shift the bias in direction of a deeper retracement, whereas preserving above it preserves the advance.

(The technical diagnosis of this memoir changed into once written with the succor of an AI tool.)

US Greenback FAQs

The US Greenback (USD) is the legit currency of the United States of The USA, and the ‘de facto’ currency of a fundamental desire of diverse nations where it is stumbled on in circulation alongside native notes. It is basically the most closely traded currency on the planet, accounting for over 88% of all global international substitute turnover, or a median of $6.6 trillion in transactions per day, in step with data from 2022.

Following the 2nd world battle, the USD took over from the British Pound because the field’s reserve currency. For most of its historical previous, the US Greenback changed into once backed by Gold, till the Bretton Woods Agreement in 1971 when the Gold Phenomenal went away.

A very remarkable single ingredient impacting on the associated rate of the US Greenback is monetary coverage, which is fashioned by the Federal Reserve (Fed). The Fed has two mandates: to cease tag balance (grasp watch over inflation) and foster elephantine employment. Its fundamental tool to cease these two objectives is by adjusting pastime charges.

When prices are rising too rapidly and inflation is above the Fed’s 2% aim, the Fed will elevate charges, which helps the USD cost. When inflation falls under 2% or the Unemployment Price is too excessive, the Fed would possibly presumably decrease pastime charges, which weighs on the Greenback.

In low eventualities, the Federal Reserve can furthermore print more Greenbacks and enact quantitative easing (QE). QE is the device in which the Fed considerably increases the waft of credit in a stuck financial gadget.

It is some distance a non-long-established coverage measure primitive when credit has dried up because banks will now not lend to every diverse (out of the worry of counterparty default). It is some distance a closing resort when simply lowering pastime charges is now not going to cease the fundamental result. It changed into once the Fed’s weapon of desire to fight the credit crunch that occurred at some level of the Enormous Financial Disaster in 2008. It entails the Fed printing more Greenbacks and the utilization of them to catch US authorities bonds predominantly from financial institutions. QE generally leads to a weaker US Greenback.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops shopping bonds from financial institutions and doesn’t reinvest the indispensable from the bonds it holds maturing in new purchases. It is some distance on the entire plod for the US Greenback.