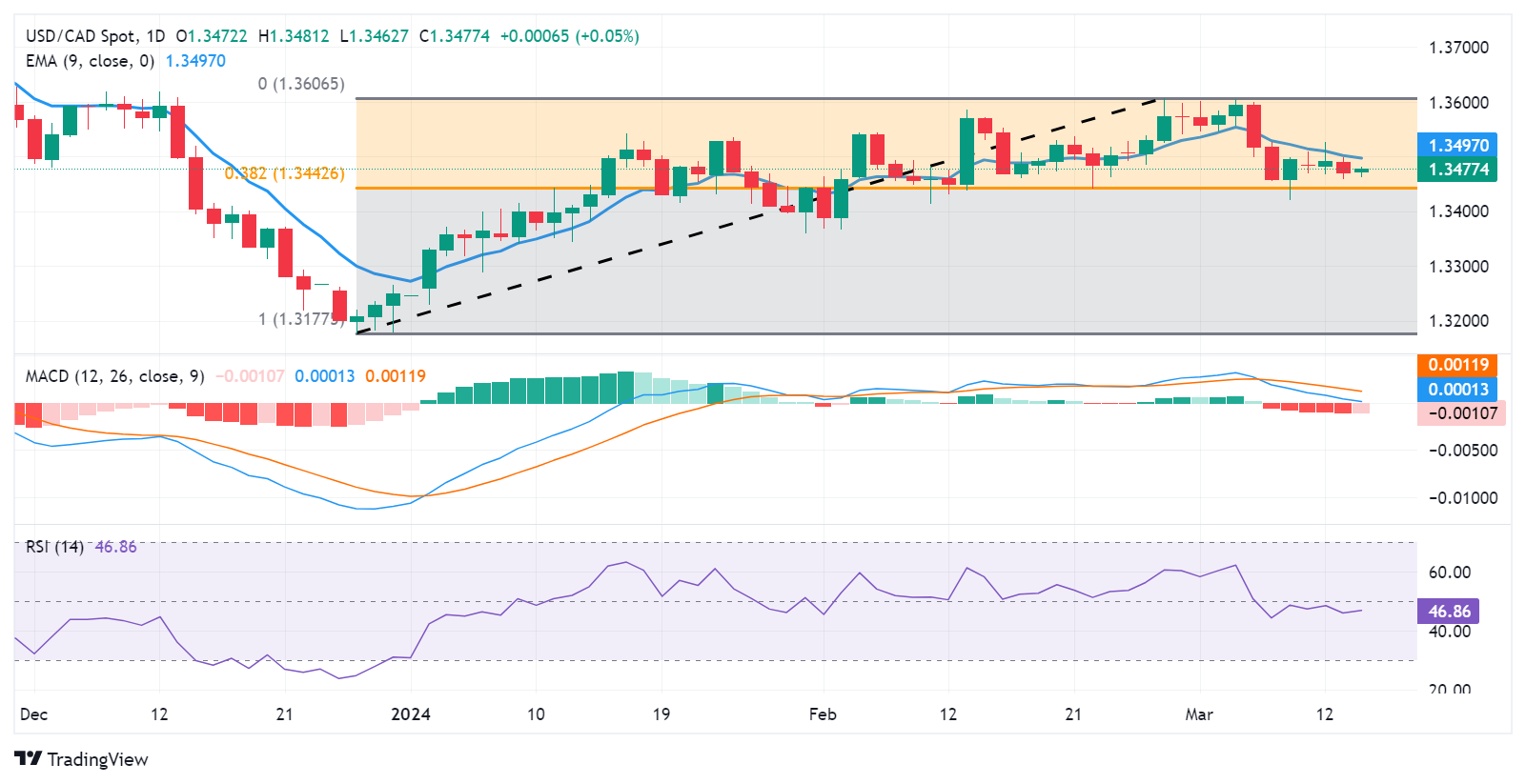

USD/CAD Price Analysis: Reaches higher to near 1.3480 ahead of nine-day EMA

- USD/CAD would possibly perchance perchance take a look at a nine-day EMA of 1.3497 and a psychological level of 1.3500.

- The major level of 1.3450 and the 38.2% Fibonacci retracement level of 1.3442 would possibly perchance perchance act as key improve levels.

- A damage above the 1.3600 level would possibly perchance perchance lead the pair to take a look at March’s high of 1.3605.

USD/CAD retraces its recent losses from the outdated session, edging upwards to end to 1.3480 for the length of Thursday’s European session. The US Dollar (USD) receives improve from increased US Treasury yields, likely influenced by recent info indicating sticky inflation within the United States (US).

The instantaneous resistance is at the nine-day Exponential Intriguing Average (EMA) at 1.3497, coinciding with the psychological level of 1.3500.

A breakout above the psychological level would possibly perchance present upward improve for the USD/CAD pair, with the following resistance at the principle level of 1.3550. Extra upside momentum would possibly perchance perchance goal the assign around the psychological level of 1.3600, aligned with March’s high of 1.3605.

On the downside, the USD/CAD pair would possibly perchance perchance come across vital improve around the principle level of 1.3450, adopted by the 38.2% Fibonacci retracement level at 1.3442. A breach beneath this level would possibly perchance perchance exert downward stress on the pair, potentially main it towards the improve zone end to the outdated week’s low of 1.3419 and the psychological level of 1.3400.

The technical diagnosis indicates blended signals for the USD/CAD pair. The 14-day Relative Strength Index (RSI) is positioned beneath 50, suggesting bearish momentum. On the opposite hand, the Intriguing Average Convergence Divergence (MACD) suggests a attainable momentum shift.

The MACD line is above the centerline, indicating bullish momentum, but there may be divergence beneath the ticket line. Traders would possibly perchance perchance look forward to confirmation from the MACD, a lagging indicator, to resolve the route of the vogue.

USD/CAD: Day-to-day Chart

Recordsdata on these pages contains forward-taking a see statements that gain dangers and uncertainties. Markets and instruments profiled on this page are for informational features handiest and must now not in any manner locate as a recommendation to aquire or sell in these property. It’s essential to reside your have thorough compare earlier than making any funding decisions. FXStreet doesn’t in any manner guarantee that this info is free from mistakes, errors, or self-discipline matter misstatements. It also doesn’t guarantee that this info is of a effectively timed nature. Investing in Birth Markets entails a huge deal of chance, at the side of the inability of all or a share of your funding, as well to emotional distress. All dangers, losses and prices connected to investing, at the side of total lack of foremost, are your accountability. The views and opinions expressed listed below are those of the authors and reside now not basically reflect the official policy or assign of FXStreet nor its advertisers. The writer would possibly perchance perchance now not be held to blame for info that is found at the cease of links posted on this page.

If now not otherwise explicitly mentioned within the body of the article, at the time of writing, the author has no assign in any stock mentioned listed right here and no alternate relationship with any company mentioned. The writer has now not received compensation for writing this text, as opposed to from FXStreet.

FXStreet and the author reside now not present customized solutions. The writer makes no representations as to the accuracy, completeness, or suitability of this info. FXStreet and the author would possibly perchance perchance now not be chargeable for any errors, omissions or any losses, injuries or damages coming up from this info and its sigh or employ. Errors and omissions excepted.

The writer and FXStreet must now not registered funding advisors and nothing listed right here is intended to be funding advice.