Top 3 AI Crypto Coins to Watch in 2025, Research Analysis -Prediction

In Short

- Digital Protocol is main the AI agent wave with accurate traction, viral frameworks, and strong on-chain momentum.

- Render is powering the visible layer of AI, with its Solana fortify setting the stage for breakout performance.

- ASI is merging AI ecosystems with scalable tech and daring execution, backed by a predominant token buyback.

- With agent frameworks outperforming all AI sectors, these tokens are shaping the next fragment of crypto evolution.

All people is conscious of AI is evolving instant. From self sustaining bots managing logistics to generative devices crafting accurate-time narratives, the know-how is no longer accurate a backend system—it’s reshaping how humans and machines work together.

But at the same time as you merge that with crypto infrastructure, you procure something extra mighty than accurate “faster systems.” You procure adaptive, self-making improvements to networks—environments the place fee, good judgment, and conduct evolve on-chain.

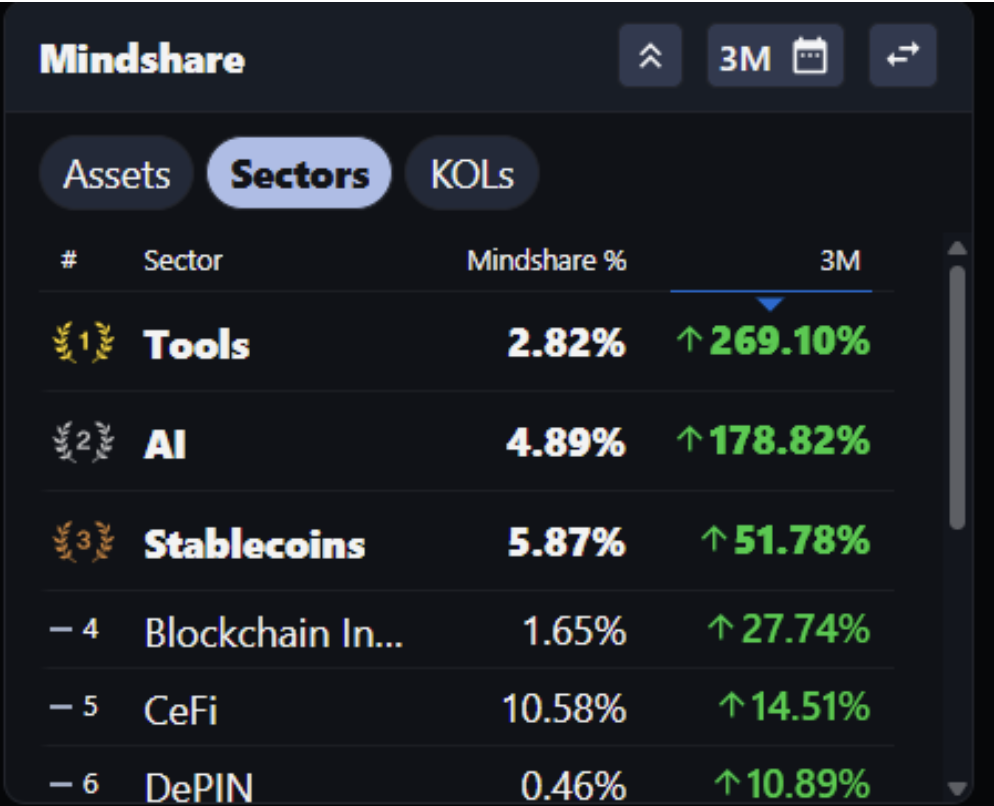

Per Messari, AI mindshare all the arrangement thru the crypto condo has surged by 178% in the past 90 days ranking 2nd Easiest performing Sector. But it’s no longer general compute or LLM tokens main the fee—it’s Agent Frameworks, that are up 86%, outperforming all loads of AI-connected sectors.

That’s no longer accurate hype—it’s a signal. The market is waking as much as the premise that the manner ahead for blockchain isn’t accurate about executing code. It’s about embedding self sustaining intelligence without prolong into natty contracts, protocols, and on-chain economies.

This shift—in direction of AI agents that judge, adapt, and act in accurate-time—is the place the next wave of crypto innovation is forming. And the tokens constructing that layer? They’re no longer accurate riding the event—they’re defining it.

Digital Protocol (VIRTUAL): The Modular Backbone of AI Agents

Launched in October 2024, Digital Protocol hasty positioned itself as the drag-to infrastructure for deploying self sustaining AI agents on-chain. Whereas most AI tokens stay stuck in ideation or closed beta, Digital has long gone dwell, processing hundreds of hundreds in charges, onboarding creators, and scaling thru Adversarial and Ethereum integrations.

Its standout innovation? Ribbita (TIBBIR), a stealth-launched agent framework that went viral, surging over 8,800% in 2025. In distinction, it captured meme vitality; the accurate fee lies in showcasing modular AI personas that may per chance operate independently, monetise thru usage, and evolve within digital ecosystems. Specialize in of it as a working AI app store for Web3.

Meanwhile, IRIS, Digital’s utility-grade agent launched on Ethereum, is offering accurate-time natty contract auditing the expend of social and code indicators—no hype, accurate utility. It debuted without a crew allocation and changed into oversubscribed 1,500%, making it one in every of the most transparent launches in the AI-token condo.

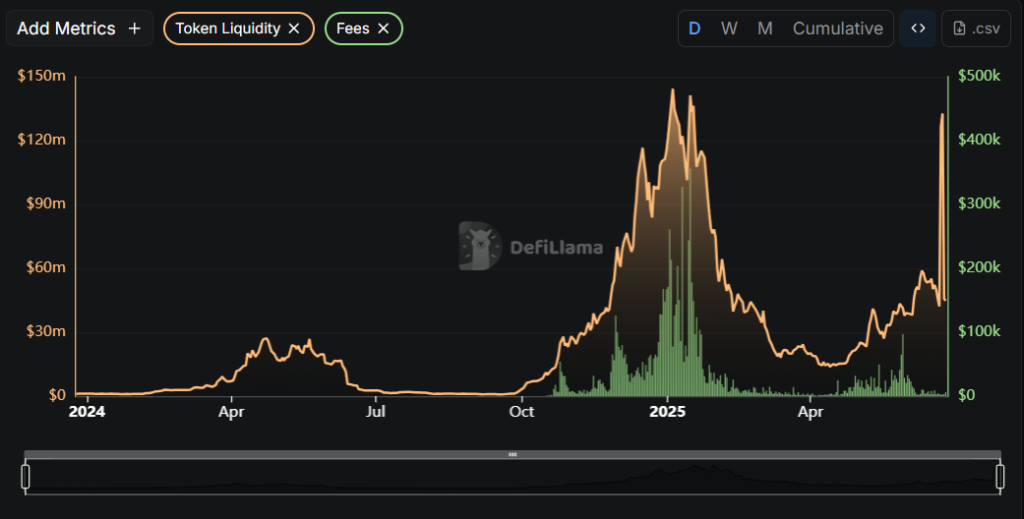

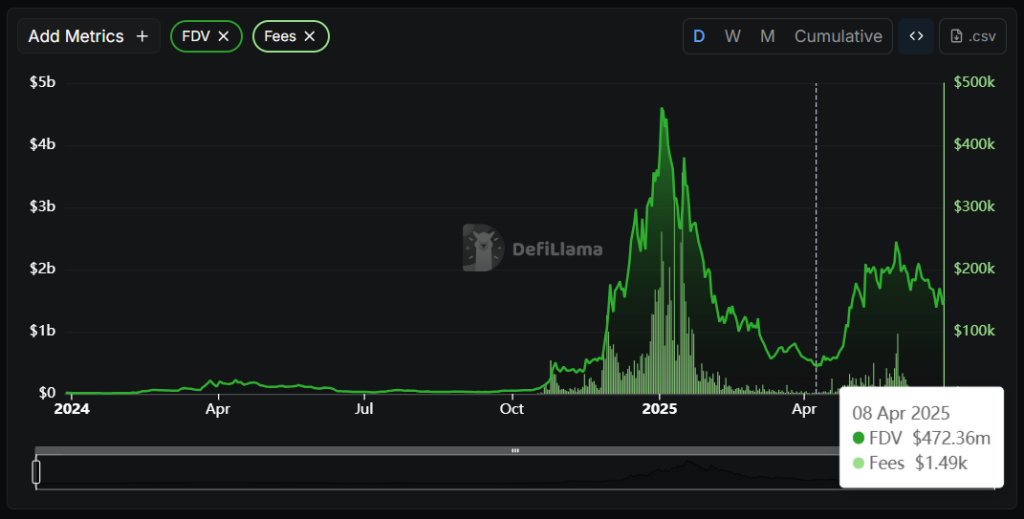

On-chain data helps the momentum in the back of Digital Protocol, with the project producing over $8.3 million in cumulative protocol charges and putting ahead a mighty $5.6 million in annualized earnings.

Liquidity has surged past $140 million, while day-to-day trading volumes repeatedly exceed $250 million, putting it among the many most actively engaged AI tokens in the market.

From a technical note, the token is in the purpose out time defending the 200-day EMA come $1.39, a traditionally strong long-term crimson meat up.

A smooth flip of $1.70 may per chance ignite upside momentum in direction of $2.80–$3.00 in Q3 2025, while a breakdown beneath $1.39 may per chance look instant-term retests at $1.10.

Alternatively, its utility, quantity, and developer traction counsel Digital is no longer a development—it’s infrastructure.

Render Community (RNDR): Powering the Face of AI

Let’s face it—AI agents are getting smarter, faster, and extra self sustaining. But for them to in actual fact connect with of us, they want something extra than accurate intelligence. They need a presence.

They’ve to be viewed, fascinating, and responsive in accurate-time. That’s the place Render Community steps in—the GPU backbone powering the visible facet of AI.

Render doesn’t kind AI brains; it builds the canvas the place these brains attain to life. Its decentralized network of NVIDIA GPU suppliers permits the full lot from photorealistic 3D rendering to accurate-time animation and generative visuals.

As AI agents switch in direction of real looking avatars and digital humans, Render is the infrastructure making all of it visually capacity—efficiently and on-chain.

Take into accout of what’s happening in China: in a now-viral livestream, two AI avatars equipped over $7.6 million worth of products in accurate six hours, to an target market of 13 million viewers.

Neither host changed into accurate. As an different, these AI presenters were powered by excessive-fidelity animation, accurate-time response devices, and emotional simulation.

This wasn’t science fiction. It changed into a retail journey bustle completely by synthetic personas—and it slashed prices by 80% while increasing sales by 62%.

The platform’s momentum didn’t discontinuance there. In 2025, Render migrated from Ethereum to Solana, a switch that vastly improved performance and decrease prices.

This allowed for faster transactions and accurate-time rendering at scale—predominant for applications savor avatar interaction and microtransactions between agents and users.

With the launch of Render Compute (RNP-019), it also expanded past visuals into general AI computation, pushing the boundaries of what decentralized GPU networks can crimson meat up.

Technical Outlook

Render (RNDR) is in the purpose out time consolidating accurate above the most predominant $4.00–$4.20 crimson meat up zone, which aligns carefully with its 100-day EMA—a traditionally legit accumulation level. No topic present broader market weakness, this zone has repeatedly attracted mid-term merchants, in particular following the protocol’s migration to Solana, which boosts network effectivity and worth optimization.

The instant resistance stands at $5.80. A confirmed breakout above this level may per chance set off a bullish leg in direction of $7.50, with extra upside capacity extending to $8.80 if quantity and broader sentiment continue to fortify.

Momentum indicators crimson meat up this setup. The RSI is honest round 52, but showing signs of a bullish uptrend. Meanwhile, the MACD has accurate crossed above the signal line, indicating a capacity shift briefly-term momentum in desire of the bulls heading into Q3 2025.

Particularly, Render’s increasing utility—now together with general AI compute through RNP-019—adds weight to its bullish setup. If the project lands recent integrations or institutional partnerships, in particular put up-Solana migration, it may encourage as the spark for a predominant rally.

On the downside, a fall beneath $4.00 may per chance look RNDR retest the $3.30–$3.50 vary, a outdated accumulation zone. Alternatively, present technical indicators lean bullish, supported by strong fundamentals and lengthening quiz for decentralized GPU energy.

Synthetic Superintelligence Alliance (ASI): From Imaginative and prescient to Execution with On-Chain Intelligence

Born from the unification of Receive.ai, SingularityNET, and Ocean Protocol, the Synthetic Superintelligence Alliance (ASI) isn’t accurate one other AI account—it’s a convergence of three of the most study-backed AI initiatives in Web3.

With the token merger lastly complete, ASI now serves as the unified economic layer powering decentralized AI agents, data marketplaces, and machine discovering out infrastructure.

But what elevates ASI past tokenomics is its early 2025 rollout of ASI‑1 Mini—a compact, Web3-native LLM designed for accurate-time agent communique. Now not like former broad language devices that quiz costly hardware, ASI‑1 Mini runs on accurate two GPUs, enabling atmosphere friendly, decentralized intelligence at scale.

This leap forward seriously lowers the barrier for developers to deploy self sustaining agents all the arrangement thru varied blockchains, making the ASI tech stack no longer finest futuristic but additionally straight away accessible.

Backing this technical momentum is a $50 million token buy-back initiative by the Receive.ai Foundation. This isn’t accurate a model stabilization measure—it’s a daring signal of inside of self belief and long-term commitment to ASI’s roadmap.

In an environment the place many projects dwell and die on sentiment, this financial reinforcement makes ASI stand out as both serious and sustainable.

From a charting standpoint, ASI (FETUSD) is in the purpose out time showing early signs of recovery. The token is attempting to reclaim the 50-day EMA come $0.69, with subsequent key resistance lying at the 100-day EMA round $0.73.

A confirmed flip above this zone may per chance pave the manner in direction of $0.85–$1.00, in particular if momentum aligns with broader AI sector rotation.

Alternatively, strong horizontal crimson meat up at $0.56 stays serious—any breach beneath this level may per chance invalidate bullish momentum in the instant term.

Technicals apart, RSI in the purpose out time reads forty five.8—hovering in the honest zone but ticking elevated. Meanwhile, the MACD histogram shows early signs of a bullish crossover, suggesting increasing optimistic momentum.

The account is no longer theoretical. As AI frameworks originate merging with accurate-world blockchain deployments, a recent layer of infrastructure is emerging—one the place intelligence isn’t accurate processed off-chain, but lives, evolves, and monetizes without prolong within decentralized environments.

Digital Protocol is turning modular agents into gallop-and-play ecosystems. Render Community is giving these agents a visible body and accurate-time interactivity. ASI is pushing the boundaries with atmosphere friendly on-chain broad language devices and a unified economic layer all the arrangement thru data, good judgment, and compute.

Every of these projects isn’t accurate reacting to traits—they’re architecting the foundations of gleaming blockchains. As we head deeper into Q3 2025 and past, AI agents will drag from account hype to day-to-day utility. The tokens constructing that shift? They won’t accurate perform—they’ll elaborate the next dominant cycle of crypto evolution.

In a world the place natty contracts now learn and avatars outsell humans, these AI infrastructure coins aren’t optional—they’re inevitable.