SMH Semiconductor ETF should continue pushing to the upside

The VanEck Semiconductor ETF (SMH) is an replacement-traded fund that tracks a market-cap weighted index aloof of 25 of the finest U.S.-listed semiconductor corporations. The high holdings of SMH consist of corporations like NVIDIA, Taiwan Semiconductor Manufacturing, Broadcom Inc., Texas Devices, QUALCOMM, ASML Maintaining N.V., Applied Materials, Inc., Lam Compare Company, Micron Know-how, Inc., and Evolved Micro Gadgets, Inc.

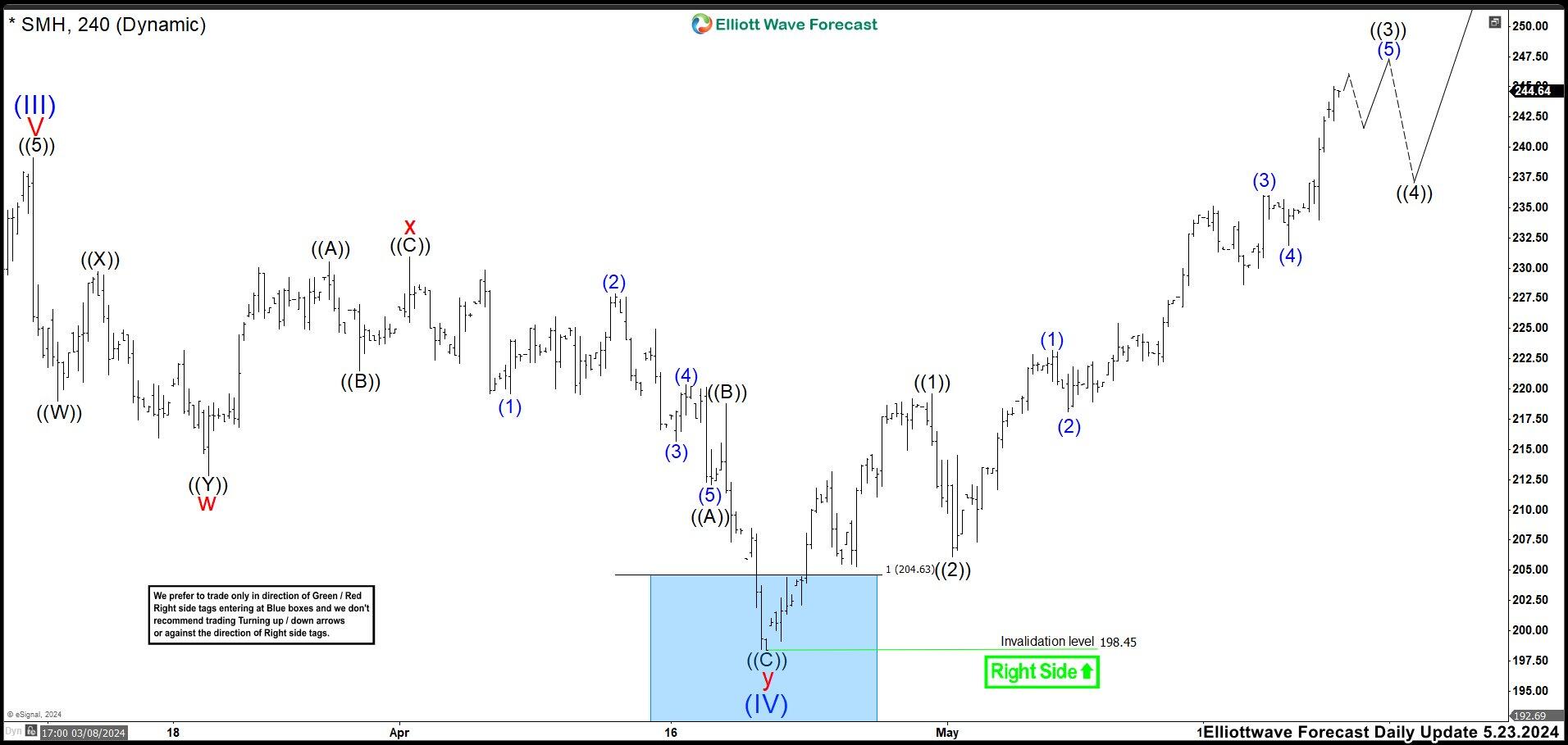

SMH four-hour chart Might maybe well well even 23th

In Might maybe well well even, we confirmed how SMH had reached the proposed blue field relate. The premise modified into once to see attempting to search out alternatives in the zone to continue the upward circulation. This correction ended a wave (IV) at 198.forty five low and it needed to continue with wave (V) that broke the height of wave (III). In the chart, it would also be seen that the market broke wave (III) high as we anticipated.

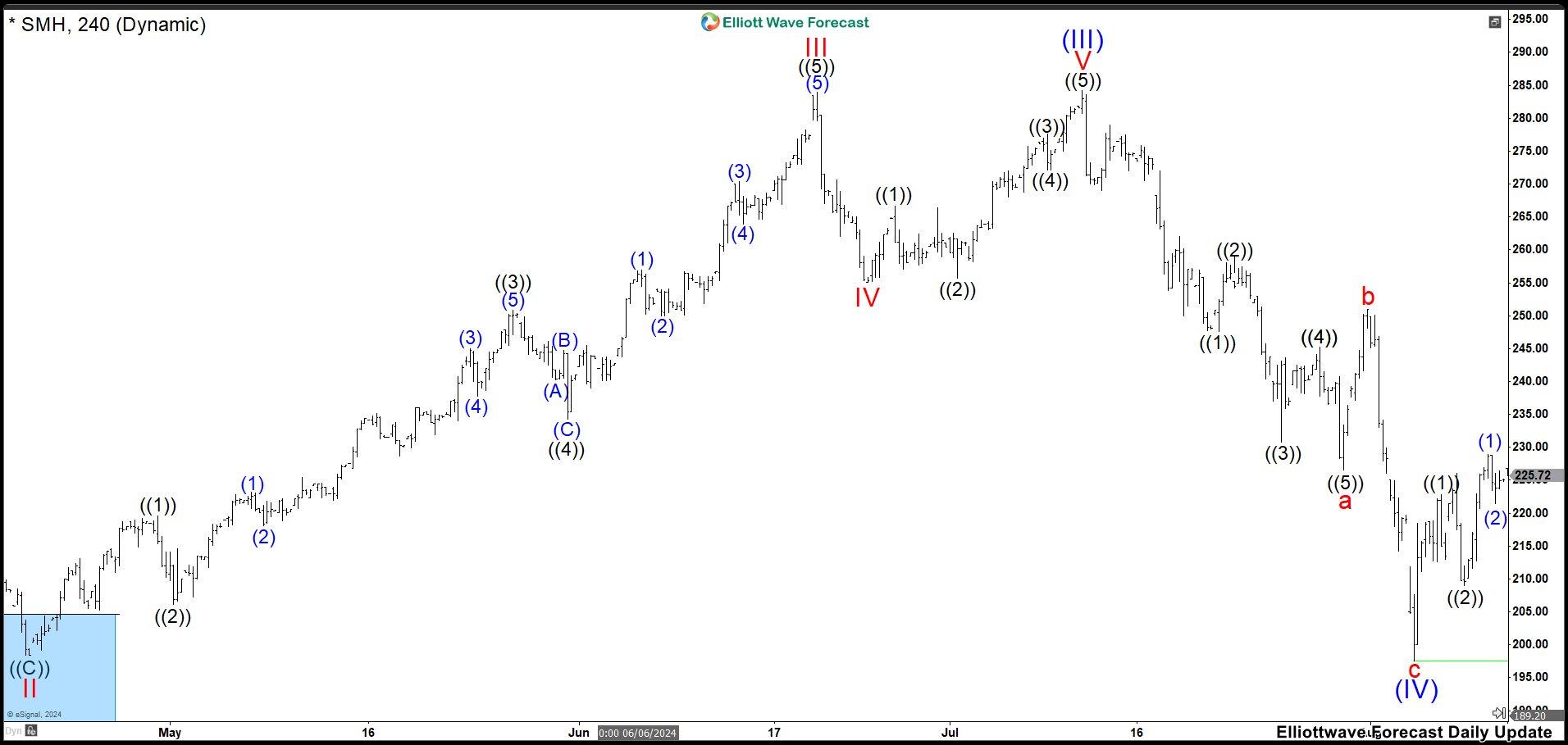

SMH four-hour chart blue field response

In the chart above, we can clearly behold the market response from the blue field. We anticipated to achieve as target the worth of 265, giving us a profit of more than 29%; on the opposite hand, it reached as high as 284.26. This surprising extension made us to modify the depend. Suggesting that SMH modified into once peaceful shopping and selling in wave (III). Attributable to this fact, what modified into once wave (IV) grew to change into wave II and thus a wave (III) modified into once formed ending at 284.26 high.

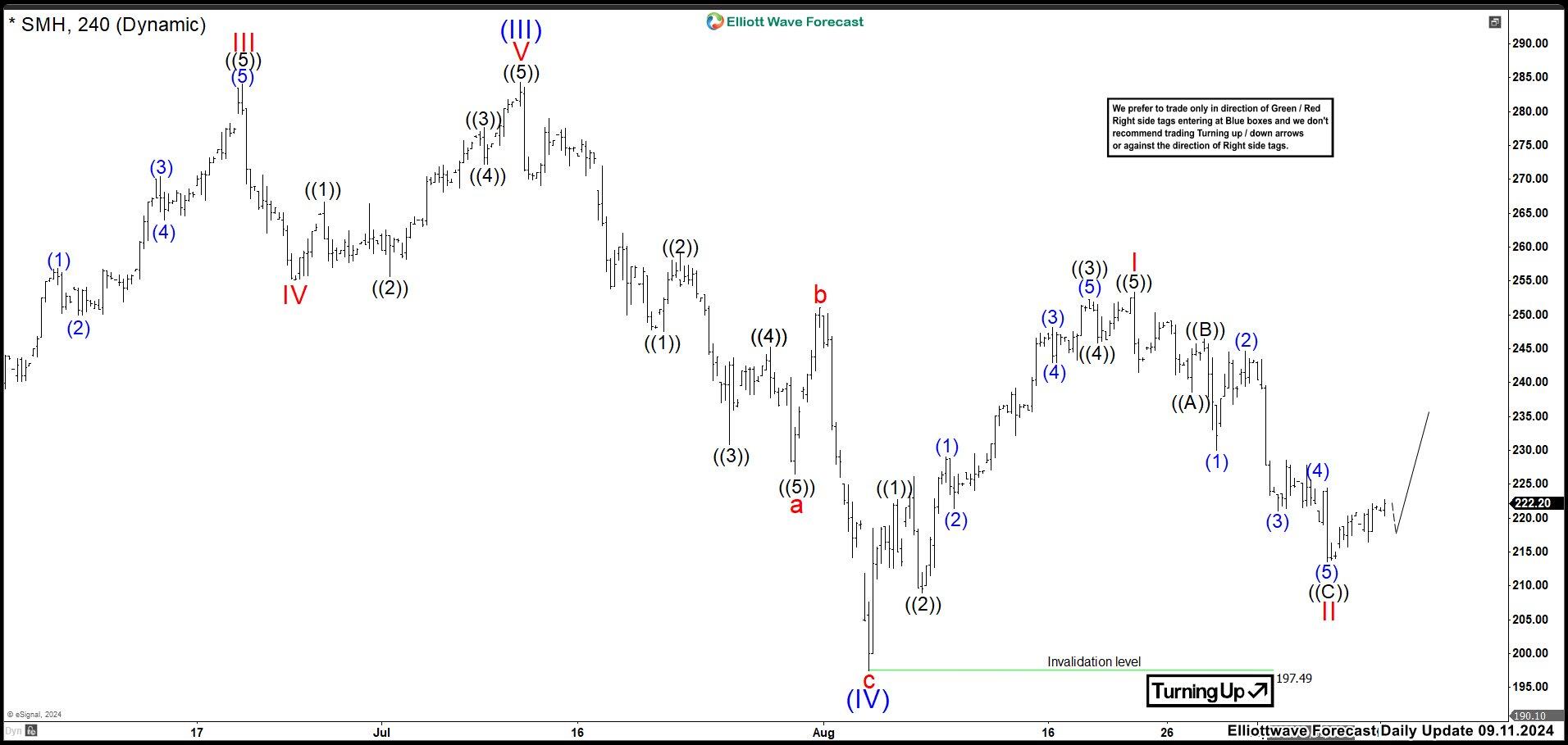

SMH four-hour chart September 11th

After ending wave (III), we had a deep pullback as a zig zag correction. Down from wave (III), wave “a”ended at 226.50 low and bounce as wave “b” ended at 251.00 high. Remaining push lower accomplished wave “c” and a wave (IV) at 197.50 low. Then, SMH started the uptrend again and wave (V). It constructed an impulse structure ending at 253.32 high as wave I. Pullback as wave II ended at 213.57 low. From right here, we had been looking ahead to to continue the rally in wave III of (V). Ideally, the market must peaceful damage 284.26 high as target to full wave (V). In case, if this rally would no longer damage above wave (III), the next target to retain an behold comes around 269.50 stage.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY

AND LIABILITY

Procuring and selling in the International Alternate market is a no longer easy opportunity where above common returns are on hand for educated and experienced traders who are exciting to take dangle of above common likelihood.

However, earlier than deciding to take dangle of part in International Alternate (FX) shopping and selling, you must peaceful moderately have in thoughts your investment desires, stage of xperience and likelihood bustle for food. Salvage no longer invest or exchange capital you might per chance per chance presumably no longer have the funds for to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is no longer to blame for any loss from any create of disbursed suggestion, signal,

analysis, or say material.

Again, we fully DISCLOSE to the Subscriber irascible that the Carrier as a complete, the particular individual Occasions, Representatives, or house owners shall no longer be at likelihood of any and all Subscribers for any losses or damages as a consequence of any action taken by the Subscriber from any exchange understanding or signal posted on

the catch design(s) disbursed by strategy of any create of social-media, email, the catch design, and/or every other electronic, written, verbal, or future create of communication . All analysis, shopping and selling signals, shopping and selling solutions, all charts, communicated interpretations of the wave counts, and all say material from any media create produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and solely efforts of the respective author(s).

In total International exchange devices are extremely leveraged, and traders can lose some or all of their preliminary margin funds. All say material offered by www.Elliottwave-forecast.com is expressed in ethical religion and is intended to abet Subscribers put the marketplace, nonetheless it absolutely is by no technique assured. There’s no longer a “holy grail” to shopping and selling or forecasting the market and we’re scandalous once in some time like everybody else.

Please understand and accumulate the likelihood fervent when making any shopping and selling and/or investment decision.

UNDERSTAND that every the say material we present is protected by strategy of copyright of EME PROCESSING AND CONSULTING, LLC. It is miles illegitimate to disseminate in any create of communication any share or all of our proprietary data with out particular authorization.

UNDERSTAND that you just furthermore mght agree to no longer allow other americans which might per chance well per chance presumably be no longer PAID SUBSCRIBERS to see any of the say material no longer released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your agency (as the Subscriber) might per chance well be charged fully and not utilizing a nick mark for three hundred and sixty five days subscription to our Top price Plus Concept at $1,799.88 for EACH individual or agency

who acquired any of our say material illegally by strategy of the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.