Semler Scientific Buys 871 More Bitcoin, Enters Top 10 Corporate Holders

Key Takeaways:

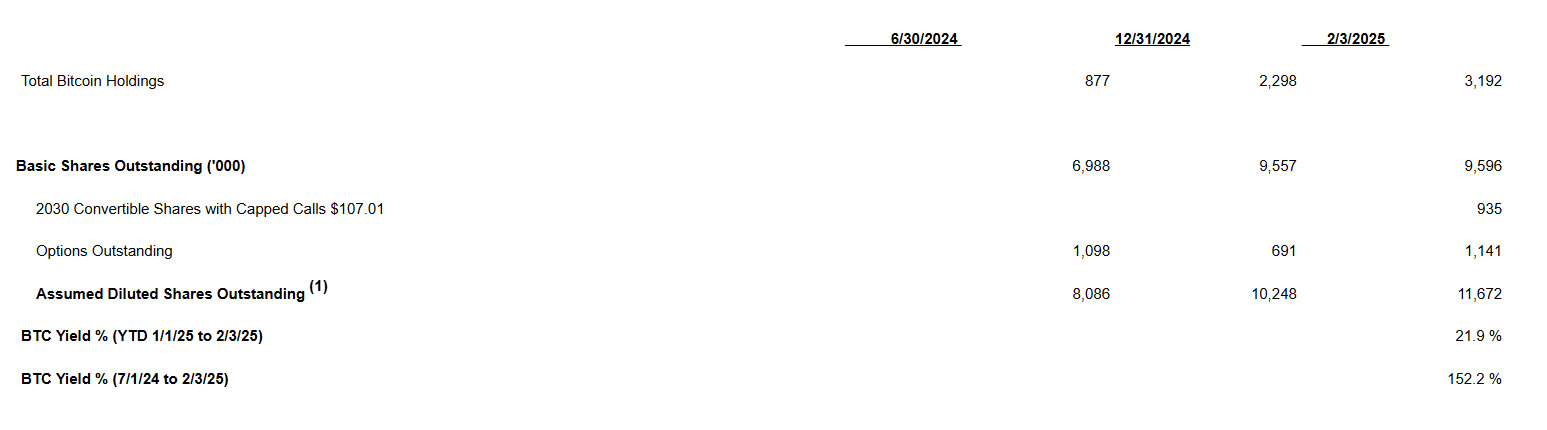

- With the acquisition of 871 extra Bitcoin, Semler Scientific has transform one of the head 10 corporate Bitcoin holders, with an complete of 3,192 BTC.

- The corporate’s Bitcoin technique has had an spectacular originate, with returns surpassing 150% since its inception.

- This cross positions Semler Scientific as one of the leading corporate adopters of Bitcoin as a treasury asset.

Introduction: Semler Scientific’s Plucky Bitcoin Switch

Semler Scientific (NASDAQ: SMLR), a healthcare expertise company that offers tools for diagnosing and treating power ailments, has surged within the tech and crypto communities via its sizable Bitcoin technique. Amid monetary scenarios reminiscent of the execute bigger in inflation and the upward thrust in economic uncertainty, Semler has identified Bitcoin as bigger than excellent a speculative funding nonetheless a solid store of payment and a that it is probably going you’ll perchance maybe additionally think hedge within the face of macroeconomic risks.

One more 871 BTC Bought: The Small print

Briefly put, within the course of the duration that passes between 11th of January and 3rd of February, 2025, Semler Scientific was once a success in acquiring more Bitcoins. Even even though some Bitcoin detractors may well well maybe additionally be reluctant to make investments within the cryptocurrency in consequence of its volatility, Semler ought to be given a immense yowl out such that its imaginative and prescient will likely be played out within the extinguish.

- Acquisition Period: January 11, 2025 – February 3, 2025

- Bitcoin Bought: 871 BTC

- Whole Funding: $88.5 million

- Life like Be conscious: $101,616 per BTC

Whole Bitcoin Holdings and Spectacular Returns

By February 3, 2025, Semler Scientific had gathered an complete of 3,192 Bitcoin, obtained at an moderate price of $87,854 per BTC, with an complete funding of $280 million. This equates to a put of roughly $313 million if the present market costs proceed. The most prominent? The return on funding.

With 3,192 Bitcoin, Semler Scientific is now amongst the head ten non-public companies keeping Bitcoin globally, according to Bitcoin Treasuries. This locations the corporate alongside lengthy-time corporate Bitcoin advocates.

| Metric | Cost |

| Whole Bitcoin Held | 3,192 BTC |

| Whole Funding Be conscious | $280 million |

| Life like Contain Be conscious | $87,854 per BTC |

| Estimated Present Cost | Approximately $313M |

The Numbers Don’t Lie: Discover-Popping Returns

- July 1, 2024 to February 3, 2025: Environmental earnings configuration of 152%

- twelve months-to-Date (2025): Expenditure of 22%!

Semler’s earnings chronicle

This data means that, no longer lower than for now, Semler’s Bitcoin funding is proving to be a profitable wager. While the past consequence does not give a obvious endorsement of the long creep, the extensive earnings is an instrument that supports the idea that Bitcoin will likely be a most treasured abstract asset. You ought to have in ideas even though that these returns are very unstable, they’ll also be swayed by the market’s temper and the indispensable economic tendencies.

Management’s Perspective

Eric Semler, Chairman of Semler Scientific, has expressed his pride with the corporate’s increasing Bitcoin holdings. Moreover, he acknowledged the nonetheless results of the convertible notes which he acknowledged proved very solid investor hobby. This displays the belief of the management, that is key in the case of handling such a disputed asset.

Bitcoin’s Role as a Strategic Reserve Asset

The emergence of some companies enjoy Semler Scientific as patrons in Bitcoin demonstrates the hasty rising style of those companies that treat Bitcoin as the strategic reserve of the money reserve. The improbable looks of Bitcoin as a tool for securing in opposition to inflation and world economic instability is turning into more evident. This uptake indicators the transferral of the technique of companies toward digital sources to the recognize of the position of digital sources in keeping capital reserves.

Market Reaction: Semler Scientific’s Stock Be conscious (SMLR)

SMLR shares took off factual away as the chronicle about Semler Scientific’s elevated Bitcoin investments hit the market. The corporate’s shares had been up by 1.55% in early buying and selling and turned a impress of the market’s belief within the corporate’s conception. Nevertheless, it’ll be saved in ideas that diversified components besides Bitcoin keeping may well well maybe additionally critically affect the shares available within the market.

Semler Scientific’s stock price went up 1.55%. Source: Google

Extra Recordsdata: MicroStrategy Starts 2025 by Shopping for 1,070 Bitcoin with a Whole Cost of $101 Million

Contrasting Approaches: Semler vs MicroStrategy

It’s a ways fascinating to explore two very diversified strategic approaches of the companies, that is Semler with MicroStrategy being the dominant corporate action-taker in Bitcoin. Desisting itself from including extra Bitcoin to its hoarded Bitcoins the keep the amount summed up to 471,017 having a cost of $46 billion, MicroStrategy firmly made up our minds to aid the present quantities. This discrepancy appears enjoy it is a ways rarely any longer excellent how their possibility appetites are happy nonetheless also their lengthy-timeframe Bitcoin thunder outlook. On the one hand is Michael Saylor, who has been the loudest and most ardent maximalist Bitcoin recommend for years, whereas Semler’s technique appears to be like to be more practical, indicative of the undeniable truth that Semler is working in a diversified sector.

Semler Scientific’s mettlesome cross to proceed to avail of its money in Bitcoin is a testament to the corporate’s self belief within the extinguish possibilities of this cryptocurrency. The solid and huge returns as successfully as the dynamic thunder of beneficial properties, mixed with Semler Scientific’s ascending assign as a top “institutional” Bitcoin proprietor, are evidence of the corporate’s breaking ranks and therefore, ascension to the pioneer space.