Polymarket Is a Success for Polygon Blockchain – Everywhere But the Bottom Line

-

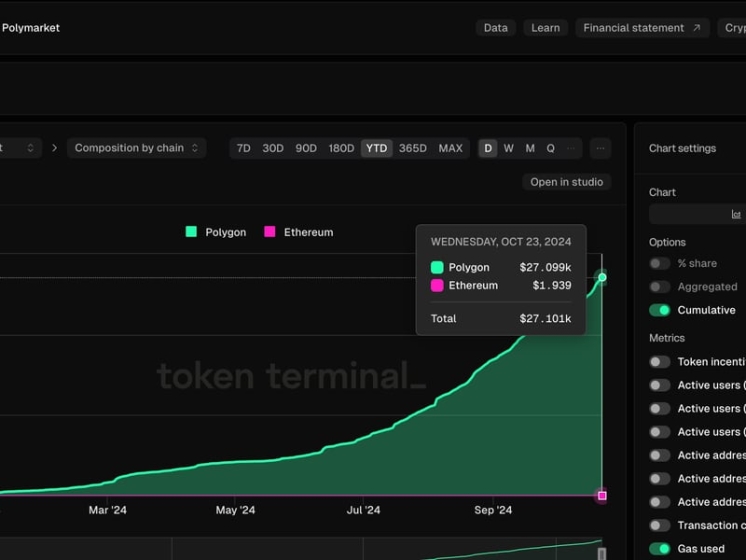

Polymarket – the decentralized predictions market – has been an enormous success for the Polygon blockchain, in phrases of being an app that is organically breaking out, getting mainstream utilization and attention.

-

Nonetheless per knowledge, Polymarket has most spicy introduced in $27,000 in payments on Polygon’s PoS blockchain in 2024.

-

Polygon Labs CEO Marc Boiron agreed that $27,000 is a low settle, but argues that this reveals how low-price it is a long way to make use of the blockchain – a selling point. The payments for transacting on Polygon is ready $0.007, with out problems below the sub-cent threshold that so a lot of groups bear centered.

-

Boiron arguest that apps like Polymarket aren’t expected to ship in mammoth revenues in transaction payments, as one would maybe well query from extra transaction-intensive applications like decentralized crypto exchanges.

One in every of the principle breakout successes this year for the team on the support of layer-2 blockchain Polygon is Polymarket – the decentralized predictions market the establish users bear flocked this year to thunder bets on every little thing from presidential politics to the conclusion of an HBO documentary.

What’s much less obvious to crypto analysts inspecting Polygon’s performance metrics is whether or now now not the coup will ship relief to holders of the project’s unwell tokens, down 65% this year.

Polymarket has soared in recognition amongst mainstream users, allowing them to manufacture bets on the upcoming U.S. presidential election. Polymarket bettors bear added practically $2.4 billion on the ask of whether or now now not Donald Trump or Kamala Harris will web the election in November. Bettors additionally currently made a market on whom a currently debuted HBO documentary about Bitcoin would attempt to call as inventor Satoshi Nakamoto.

Polymarket is built on the Polygon PoS blockchain, and the application is with out doubt one of the dear principle critical organic successes for the team – known for a past marketing strategy of paying partners like Starbucks to make use of the network.

So given the application’s enhance in utilization, why has it most spicy produced a shrimp quantity in dollar figures for the Polygon team, and barely any bump within the label of the native POL token?

In conserving with knowledge from Token Terminal, as of Oct. 23, Polymarket has most spicy introduced in about $27,000 of transaction payments for Polygon PoS in 2024.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XVZHX74LYZGJFISJABGI4J7SRA.png)

The acknowledge, in phase, is that the payments are market-primarily primarily based entirely. And now now not too lengthy ago, transacting on Polygon PoS is extraordinarily low-price.

The favored transaction price on the Polygon PoS chain on that identical day used to be $0.007.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RCKGB2W4YBDD7HHJVSQHFQZXF4.png)

Anytime a Polymarket user makes a wide gamble, they’re making a transaction on Polygon PoS. As phase of these transactions, they pay payments to Polygon PoS, which is split up into a contaminated price and a precedence price. The contaminated price would now not toddle against validators; in its establish it is a long way burned – sent to a null handle that theoretically would maybe well also aloof profit tokenholders by serving to to scale support the offer.

“That contaminated price is adjustable and or now now not it is primarily primarily based entirely off of network congestion,” Polygon Labs CEO Marc Boiron educated CoinDesk in an interview. “In tell the network will get extra congested, that contaminated price will enhance.”

The precedence price is paid out to a validator.

“You are paying the validator to train, Please embody me in a block,” Boiron added. “The bigger a price you pay, the sooner the validator will embody you in a block if there’s extra congestion.”

If there’s colossal blockspace, there’s much less of a opt to pay up.

Another grief is that, within the mountainous plan of things, whereas Polymarket’s bettors are rather active, the amount of transactions would now not device end to the stage of excessive-intensity applications like decentralized crypto exchanges (DEXs).

Thus a long way this month, 5.2% of transactions on the Polygon PoS chain came from Polymarket, per Polygon’s examine team. Chainlink makes up 10.38% of transactions on PoS, whereas transfers of the stablecoin USDT manufacture up 4.89%.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MJ3HFT6ZK5H6NCMVXAUFMC2DYA.png)

Apt to grab the instance of a recent day’s exercise. On Oct. 23, Polymarket accounted for about 8% of the “gas” broken-down on Polygon PoS, per knowledge from the blockchain explorer PolygonScan. That made it the biggest particular person contributor. In blockchain terminology, gas is a measure of the computational intensity required for any given batch of transactions.

“I gape at how or now now not it is built,” Boiron talked about. “I would maybe well under no circumstances query so a lot of payments from Polymarket, because of it would now not bear an enormous quantity of composability, like Uniswap. It has some, but now now not plenty. It be in actual fact correct users coming there. They’re executing a transaction, after which stopping. So or now now not it is inherently under no circumstances going to pressure that powerful unless, like, the probability of users goes formulation up.”

Consideration is the reward

Polygon for lengthy has sought for its mainstream leap forward 2d, pouring hundreds of thousands into the partnerships with Starbucks and Meta to envision out and ship Web3 to the plenty. Those deals under no circumstances in actual fact took off.

The Polygon team is impressed by the mammoth attention that Polymarket has been getting, hoping the eye will feed into bigger numbers within the broader Polygon ecosystem.

Boiron educated CoinDesk: “The ask is, like, why is Polymarket so spicy within the event that they are most spicy bringing $20K? The gruesome motive is correct, let’s call it attention.”

The success reveals that “you would possibly maybe also bear an amazingly worthwhile app on Polygon PoS that, akin to you are going to also, you infrequently even know that you simply’re the utilization of a blockchain,” he talked about.

To gape on the unparalleled facet, “Paying most spicy $20K in transaction payments, frankly, correct displays how low-price it is a long way to make use of Polygon PoS,” Boiron talked about.

The organic explosion of Polymarket has contributed to Polygon’s success due to eye it brings to the ecosystem, he talked about.

“Utterly different applications bear diverse roles,” Boiron talked about. “For me, Polymarket’s position contains: We’re giving them colorful low-price transactions that manufacture it very easy. And a focus is the object – that is the price add – that Polymarket brings for us.”

“Now, that is very diverse from, shall we embrace there’s anyone who comes and builds an tell e-book DEX on Polygon PoS,” he talked about. “If they were doing $20,000 of payments over multiple months, it would be an enormous failure, because of that you simply would possibly maybe query wide numbers of orders positioned and canceled and filled, then that would pressure immense numbers of transactions. So the principle right here is like, diverse applications bear diverse supposed functions.”

UPDATE (18:17 UTC): Provides bullets on the head of the legend.

Edited by Bradley Keoun.