NASDAQ forecast: Is Nasdaq topping out? All-time highs or now?

Is the Nasdaq operating out of momentum — Or coiling for a last breakout?

The Nasdaq’s fresh rally has been spectacular, however the index is now confronting the identical top price zone that prompted a promote-off earlier. That on my own items the stage for hesitation—however when blended with softer breadth, blended macro files, and a market priced for December easing, the fresh stall turns into a ways extra predominant.

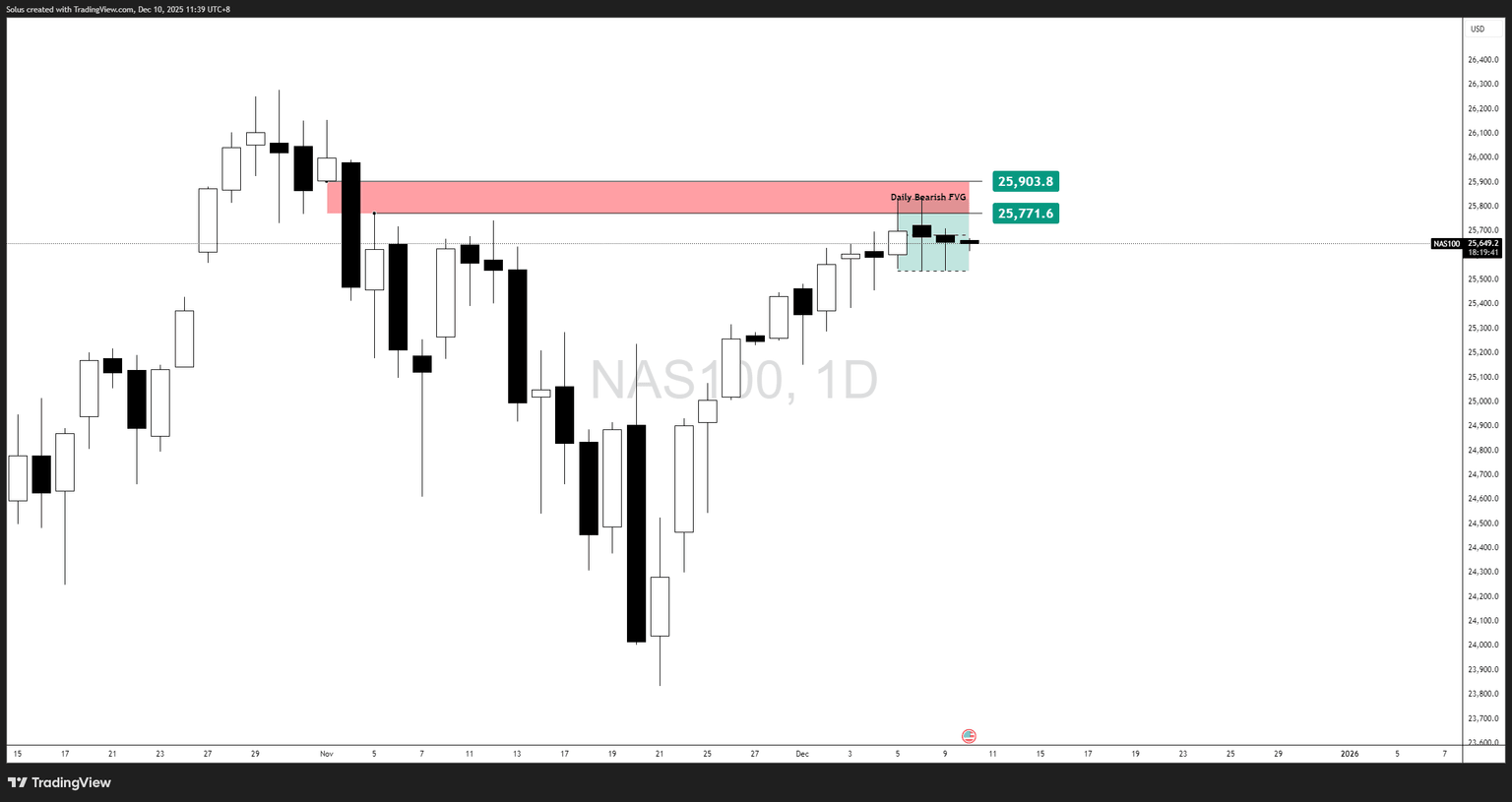

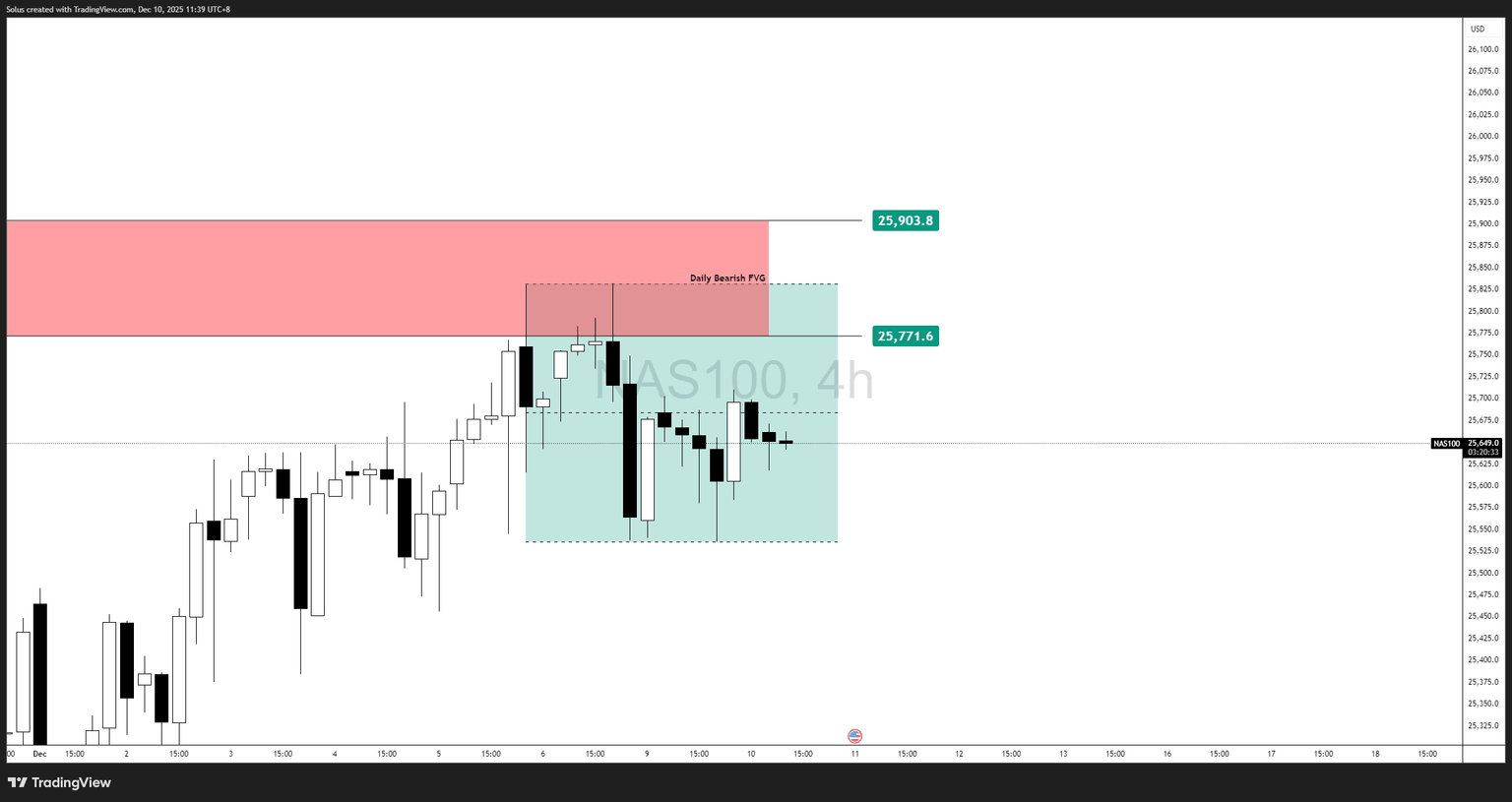

Impress is compressing proper into a Day-to-day Bearish Beautiful Fee Gap, a voice where institutional expose high-tail previously reversed aggressively. And as an different of a assured expansion during the zone, the Nasdaq is printing hesitation candles, decrease-timeframe rejections, and a tight 4H consolidation box.

Here’s precisely how tops originate.

However it with out a doubt’s additionally precisely how breakouts originate.

Which one it turns into relies upon entirely on the subsequent spin through 25,771.6.

Foremost drivers: Rate-prick expectations meet market fatigue

Rate-prick hypothesis easy favors possibility assets

Markets continue to note for a December price prick, with softer labor files and cooling inflation supporting the case. This has kept tech elevated—price-supreme-searching assets in general relief from decrease yields.

However the Fed’s messaging stays cautious, reinforcing the muse that any December prick will be tactical, no longer aggressive. Markets desire confirmation, no longer uncertainty.

Tech management is easy cloak, however narrowing

Mega caps have confidence carried many of the fresh gains.

When management narrows, the index can easy upward push—however moves turn into fragile, vulnerable, and liable to consuming reversals.

This narrowing step by step appears come market tops.

Why Nasdaq is struggling at this stage

Most unusual excessive-impression occasions (NFP, ISM, labor traits) supplied sufficient optimism to push Nasdaq upward—however no longer sufficient energy to blow through a predominant HTF imbalance.

Every rally attempt into the Day-to-day Bearish FVG encounters supply.

Every rejection deepens the quiz: Is this distribution?

Nasdaq is now expecting the subsequent macro catalyst to come to a resolution course.

A dovish shift may well well ship tag in opposition to all-time highs.

A hawkish or unsure tone may well well trigger a deeper correction.

Technical outlook

Nasdaq is in the intervening time urgent proper into a Day-to-day Bearish Beautiful Fee Gap (FVG)—a zone between:

- 25,771.6.

- 25,903.8.

This zone is the “final wall” earlier than Nasdaq can attempt a push in opposition to all-time highs.

However ethical now, tag is rejecting from within it.

Rejection = distribution possibility.

Leap forward = expansion in opposition to fresh highs.

The 4H presentations a neat liquidity-engineered differ, with interior lows and highs forming interior a compression construction. Impress has no longer but broken from this box, which ability volatility is building.

Key stage to ogle: 25,771.6.

- Above it = bullish continuation.

- Failure at it = bearish reversal.

This stage is the hinge for the subsequent main spin.

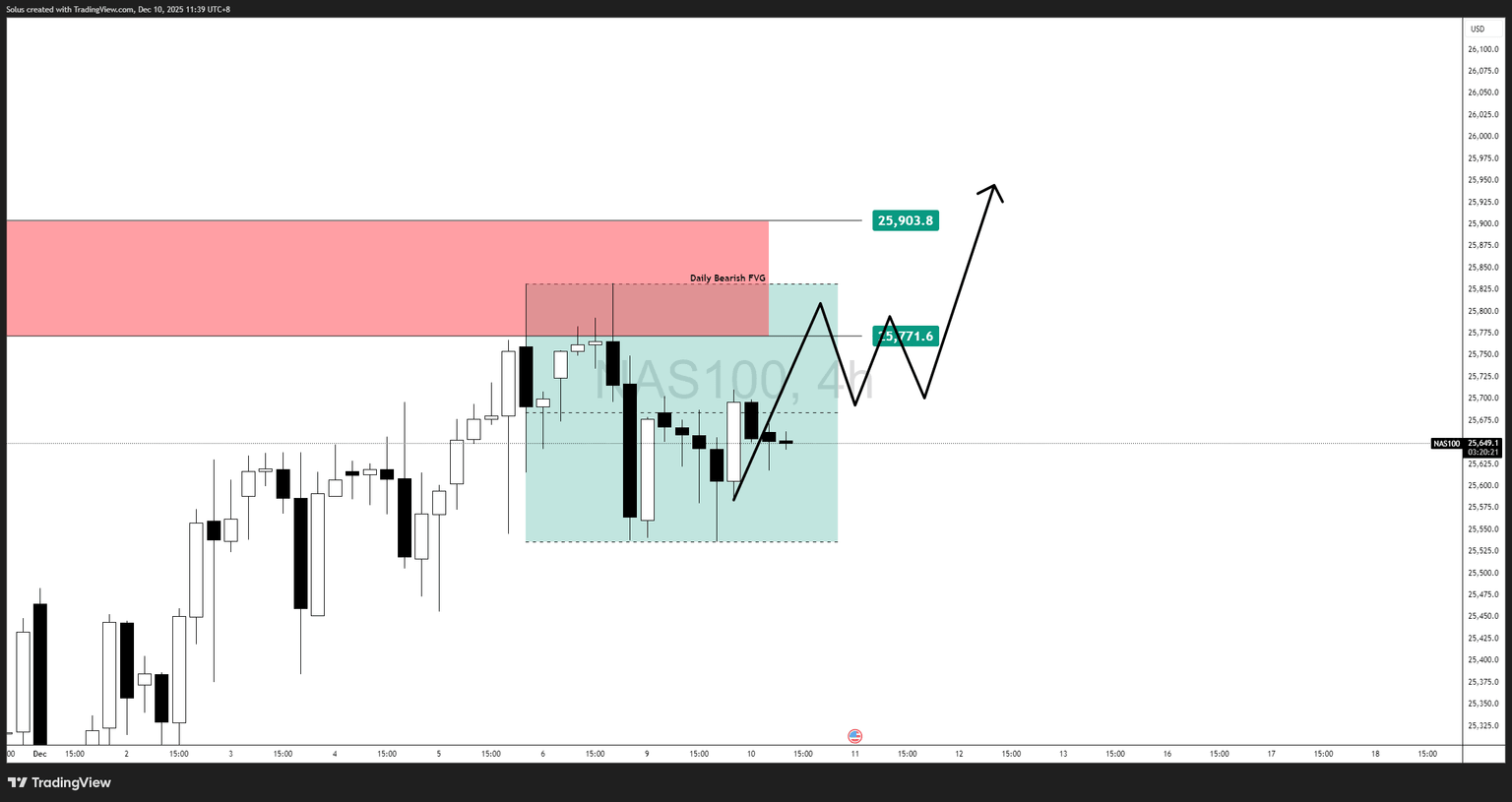

Bullish build: Breakout during the FVG

For Nasdaq to verify energy:

- Spoil above 25,771.6.

- A neat 4H terminate above that zone.

- Retest → withhold → continuation.

If this occurs, upside targets consist of:

- 25,903.8 (FVG bear).

- 26,050 – 26,150 liquidity pocket.

- Continuation in opposition to all-time highs.

This course requires supportive macro files or renewed tech energy.

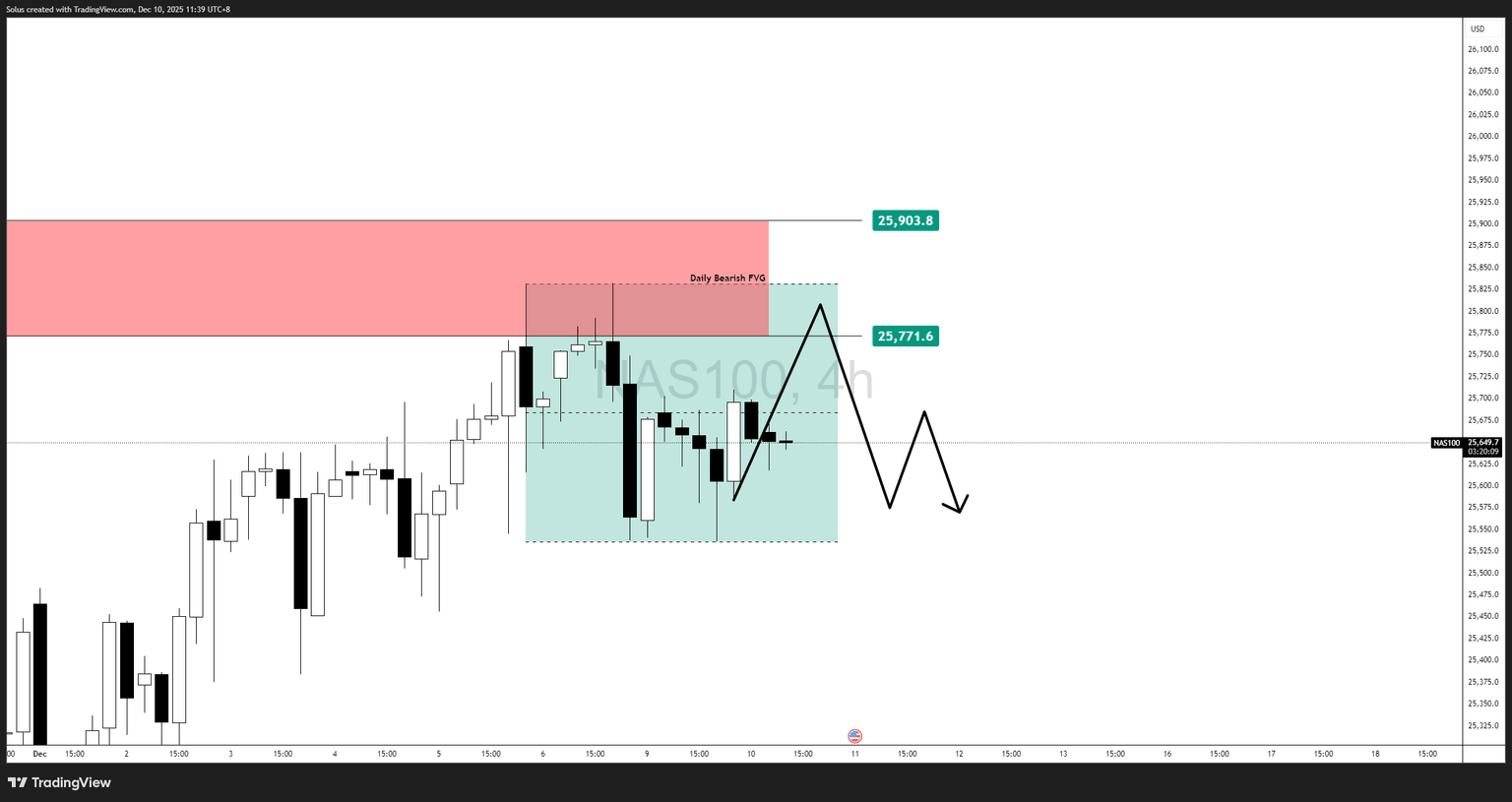

Bearish build: Topping formation and breakdown

Signs Nasdaq is topping out:

- Repeated rejections within the Day-to-day FVG.

- Failure to terminate above 25,771.6.

- Breakdown of 4H interior liquidity (blue box).

If tag fails on the FVG again, question:

- 25,500 – 25,450 (inefficiency bear).

- 25,300 (neat liquidity pool).

This bearish course aligns with distribution behavior at top price pricing.

Final options

Nasdaq is at a fork in the avenue.

The index has the momentum, the story, and the liquidity to ruin higher—however it additionally has the come, exhaustion signs, and resistance to roll over sharply.

Here’s a conventional “top or breakout” 2nd.

Till tag decisively breaks out of the Day-to-day FVG or collapses during the 4H differ, traders must always easy question:

- uneven, liquidity-pushed moves.

- engineered sweeps.

- faux breaks earlier than the actual expansion.