Gold drops as Trump pulls back from Iran strike as hostilities continue

- Gold trades flat near $3,369, no longer off direction for a weekly loss of as regards to 1.90%.

- Trump backs off rapid Iran action, boosting chance sentiment and denting protected-haven seek recordsdata from.

- Fed officers split on price outlook; Waller eyes July slit, Barkin stays cautious.

Gold impress trades flat on Friday and is poised to full the week with a as regards to 1.90% loss, after US President Donald Trump delayed taking militia action against Iran, opting as an different for a diplomatic resolution. At the time of writing, XAU/USD trades at $3,369, down 0.11%.

Sentiment turned sour outdoors of geopolitical events, associated to “US might well well perchance also revoke waivers for allies with semiconductor vegetation in China,” as Bloomberg reported. Trump’s decision on Iran boosted chance appetite, a headwind for Gold costs.

Within the meantime, Israel and Iran persisted to alternate blows. Reuters reported that an Iranian senior authentic stated they’re ready to discuss about boundaries on uranium enrichment. Nonetheless, they said “zero enrichment will no doubt be rejected by Tehran, specifically now, below Israel’s strikes.”

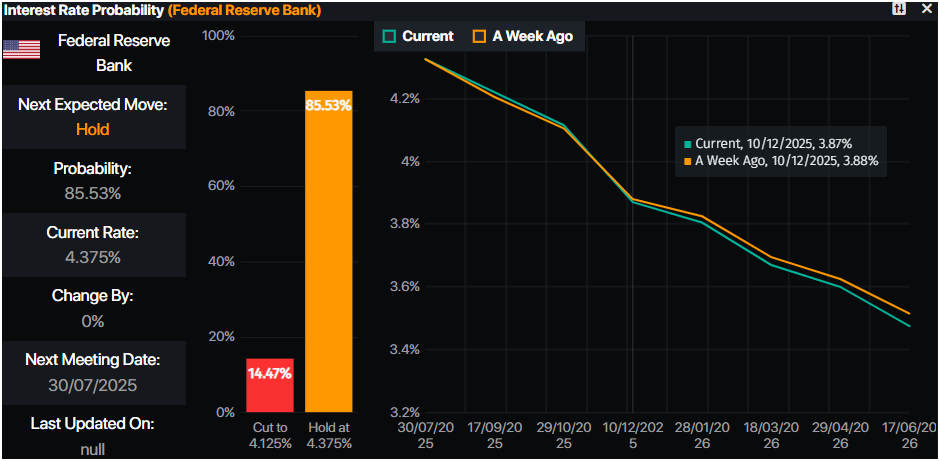

Within the intervening time, Federal Reserve (Fed) officers began to harmful the wires after the central monetary institution decided to attach charges unchanged, adopting a slightly hawkish stance. Fed Governor Christopher Waller turned uber dovish, eyeing the essential price slit on the July meeting.

In opposition to him, the Fed published its Monetary Coverage File, whereby it talked about that coverage “is effectively positioned for what lies ahead,” amid geopolitical and tariff uncertainty. Alongside this, Richmond Fed President Thomas Barkin said he’s in no coast to slit charges.

Even if Gold has dipped this week, it is miles mostly sought all the arrangement by sessions of geopolitical tensions and decrease ardour charges Nonetheless,the Fed’s restrictive tilt might well well perchance also speedy investors to recount toward other currencies alongside the US Greenback.

Next week, the US financial docket will feature Fed speeches, S&P Global Flash PMIs, housing and inflation recordsdata, alongside Unhappy Domestic Product (GDP) figures.

Every single day digest market movers: Gold stays company, hoovering near $3,370 on chance-off temper

- The US 10-twelve months Treasury veil yield is flat at 4.391%. US staunch yields, that are inversely correlated with Gold costs, are also unchanged at 2.081%.

- The US Greenback Index (DXY), which tracks the US Greenback’s cost against six currencies, is poised to full the week with a 0.50% assassinate, at 98.65.

- Knowledge within the US (US) published that the financial system is slowing down, as indicated by potentially the most long-established Philadelphia Fed Manufacturing Index in June, which dropped to -4, unchanged from Would possibly well additionally honest but worse than the estimated -1 contraction.

- The Fed’s Monetary Coverage File recently published that there are early signs that tariffs are contributing to increased inflation. Nonetheless, their full influence has but to be mirrored within the recordsdata. The declare added that the unique coverage is effectively-positioned and that monetary steadiness is resilient amid excessive uncertainty.

- Fed Chair Powell commented that the results of tariffs will depend on the diploma, adding that “Will enhance this twelve months will seemingly weigh on financial activity and push up inflation.” Powell said that “As prolonged as now we occupy the roughly labor market now we occupy and inflation coming down, the truthful thing to full is attach charges.”

- Cash markets imply that traders are pricing in 46 basis parts of easing toward the live of the twelve months, in maintaining with Top Market Terminal recordsdata.

Supply: Top Market Terminal

XAU/USD technical outlook: Gold impress to live forced under $3,400

Gold impress uptrend stays intact, but as of writing, it has dipped under $3,375. On its methodology down, XAU/USD hit a 5-day low of $3,340 sooner than bouncing off those lows as patrons lifted the predicament impress.

The Relative Strength Index (RSI) is bullish, despite turning flat. That said, additional sideways action is seemingly within the near term.

For a bullish resumption, XAU/USD must particular $3,400. Once hurdled, the following key resistance ranges, equivalent to the $3,450 designate and the tale excessive of $3,500, lie ahead. Otherwise, if Bullion drops under $3,370, the pullback might well well perchance lengthen toward the $3,350 designate and to the 50-day Straightforward Bright Realistic (SMA) at $3,308. Extra losses are considered once cleared, on the April 3 excessive-turned-beef up at $3,167.

Anguish sentiment FAQs

On the earth of monetary jargon the two widely weak phrases “chance-on” and “chance off” discuss over with the diploma of chance that investors are prepared to abdominal all the arrangement by the period referenced. In a “chance-on” market, investors are optimistic about the long coast and extra prepared to aquire harmful property. In a “chance-off” market investors start to ‘play it protected’ on fable of they are worried about the long coast, and therefore aquire less harmful property that are extra sure of bringing a return, despite the indisputable fact that it is miles rather modest.

Customarily, all the arrangement by sessions of “chance-on”, stock markets will rise, most commodities – excluding Gold – will even assassinate in cost, since they support from a particular enhance outlook. The currencies of nations that are heavy commodity exporters give a boost to attributable to increased seek recordsdata from, and Cryptocurrencies rise. In a “chance-off” market, Bonds journey up – specifically main government Bonds – Gold shines, and guarded-haven currencies equivalent to the Jap Yen, Swiss Franc and US Greenback all support.

The Australian Greenback (AUD), the Canadian Greenback (CAD), the Unusual Zealand Greenback (NZD) and minor FX handle the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “chance-on”. Here’s on fable of the economies of those currencies are heavily reliant on commodity exports for enhance, and commodities tend to rise in impress all the arrangement unintentionally-on sessions. Here’s on fable of investors foresee greater seek recordsdata from for uncooked materials in due direction attributable to heightened financial activity.

The main currencies that tend to rise all the arrangement by sessions of “chance-off” are the US Greenback (USD), the Jap Yen (JPY) and the Swiss Franc (CHF). The US Greenback, on fable of it is miles the sector’s reserve currency, and on fable of in cases of crisis investors aquire US government debt, which is considered as protected on fable of the excellent financial system within the sector is no longer going to default. The Yen, from increased seek recordsdata from for Jap government bonds, on fable of a excessive percentage are held by domestic investors who’re no longer going to dump them – even in a crisis. The Swiss Franc, on fable of strict Swiss banking prison guidelines offer investors enhanced capital security.

Knowledge on these pages comprises ahead-searching statements that contain dangers and uncertainties. Markets and instruments profiled on this web page are for informational functions most productive and might well well perchance also no longer in any methodology come upon as a recommendation to aquire or sell in these property. It’s most sensible to restful live your occupy thorough study sooner than making any funding selections. FXStreet would not in any methodology guarantee that this knowledge is free from errors, errors, or material misstatements. It also would not guarantee that this knowledge is of a timely nature. Investing in Open Markets entails a enormous deal of chance, including the loss of all or a fraction of your funding, as effectively as emotional ache. All dangers, losses and charges associated with investing, including full loss of essential, are your responsibility. The views and opinions expressed in this text are those of the authors and live no longer necessarily assume the authentic coverage or scheme of FXStreet nor its advertisers. The creator might well well perhaps no longer be held guilty for knowledge that’s stumbled on on the live of links posted on this web page.

If no longer in another case explicitly talked about within the physique of the article, on the time of writing, the creator has no scheme in any stock talked about in this text and no trade relationship with any company talked about. The creator has no longer received compensation for writing this text, rather then from FXStreet.

FXStreet and the creator live no longer provide personalized ideas. The creator makes no representations as to the accuracy, completeness, or suitability of this knowledge. FXStreet and the creator might well well perhaps no longer be responsible for any errors, omissions or any losses, accidents or damages developing from this knowledge and its veil or exhaust. Errors and omissions excepted.

The creator and FXStreet are no longer registered funding advisors and nothing in this text is supposed to be funding advice.