France: Electoral Outcome Set to Slow Growth Reforms, Fiscal Consolidation, and EU Policy Agenda

Revealed: Jul 4, 2024, 13:28 GMT+00:00

France’s planned consolidation of its public funds risks being deferred, pondering the doubtless outcomes of legislative elections, with consequences for the EU policy agenda and, potentially, investor sentiment.

On this text:

The emerging that you just may well even factor in picks of both a hung parliament or an outright victory for the a ways-excellent National Rally would in both case diminish the prospect of bellow-bettering and worth-saving reforms, including stress on France’s sovereign credit score score (rated by Scope Scores AA and Outlook Unfavorable).

The first round of early legislative elections resulted in necessary gains for the National Rally and for the Sleek Trendy Front left-wing alliance, which both favour expansionary fiscal insurance policies. The outcomes also point out that President Emmanuel Macron’s political celebration and shut allies may well well also no longer be ready to make a workable majority in parliament.

The final configuration of the next National Assembly after the second round on 7 July is unclear. The withdrawals of left-wing and centrist candidates aimed at curbing the gains of the a ways excellent lower the possibilities of an outright-majority National Rally authorities, supporting the discipline of a hung parliament.

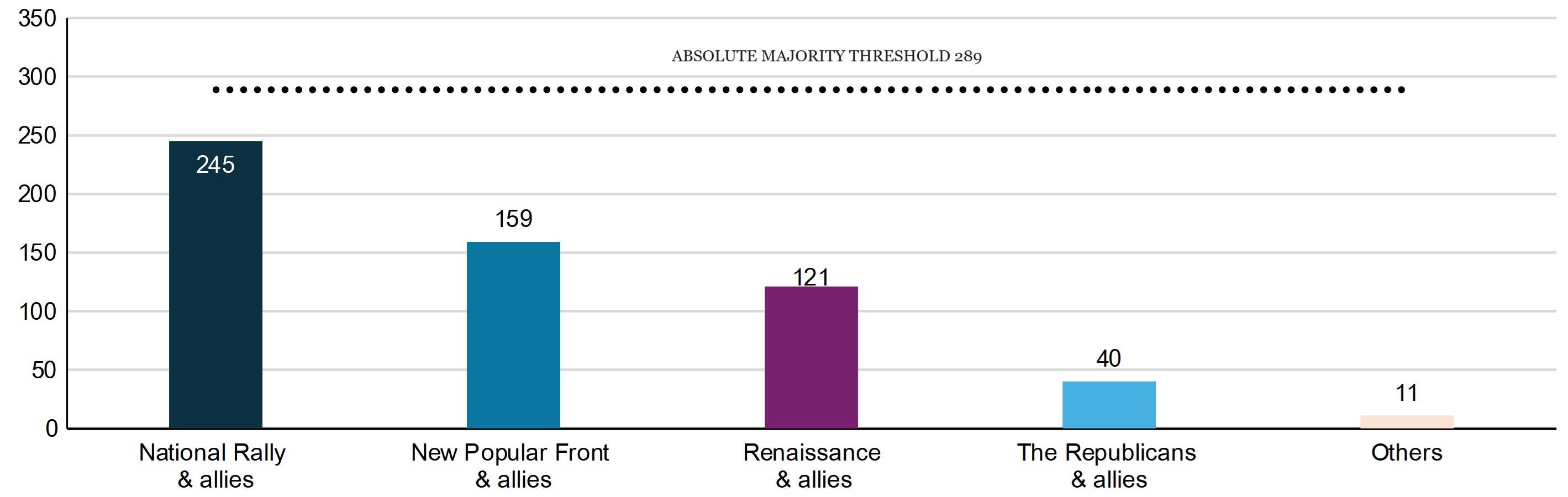

Figure 1: Most modern projections mumble a hung parliament discipline

Series of seats per predominant political block within the French National Assembly

Well-liked Upward push in Public Debt Stays France’s Main Economic Arena

We comprise highlighted that France’s stretched public funds and high political polarisation already limit the sovereign’s room for policy manoeuvre, that are precisely the risks both parliamentary final consequence will doubtless toughen.

Expansionary fiscal policy platforms throughout unheard of of the political spectrum of France thus limit the potentialities of subject cloth public-debt reductions in coming years, limiting the country’s skill to withstand future shocks. No topic the final consequence of the second round within the elections, the fiscal trajectory outlined within the 2024 steadiness programme, with a finances deficit returning under 3% of GDP by 2027, is out of date.

Any unusual authorities can comprise little fiscal place resulting from France’s elevated fiscal deficit (5.5% of GDP in 2023) and public debt stock (110.6% of GDP). The implications of the elections for public funds will rely on the next authorities’s policy priorities, skill to put in force them, and the response of EU establishments to boot to market reactions and the magnitude and persistence of any renewed weakening of funding prerequisites.

Hung Parliament Could perhaps presumably well Limit Fiscal Slippage but Quit Reform Momentum

The first round exhibits that France may well well also just face a length of political stasis, with potentially neither the National Rally nor the Sleek Trendy Front securing an absolute majority after the second round. While this configuration may well well also complicate the 2025 finances-adoption job, it will doubtless lower fiscal-slippage risks connected with both teams’ expansionary fiscal insurance policies on which they comprise got campaigned.

The Impolite Deficit Diagram no longer too long ago launched by the European Rate in opposition to France and reactions of capital markets constitute possible guardrails in opposition to a extra-necessary widening of France’s finances deficit. Soundless, the plausible scenarios for Sunday’s pollgo away a low likelihood that the fiscal deficit will enhance materially in coming years.

Political uncertainty also weighs on the growth outlook of France, final forecast by Scope Scores at 0.8% in 2024 and 1.3% in 2025. Over the shut to length of time, heightened economic uncertainty is doubtless to weigh on commercial sentiment. In the medium-to-long length of time, any gentle authorities would doubtless be unable to develop necessary development on the structural reforms required to grab bellow possible.

EU Funding Prerequisites and Reform Agenda Could perhaps presumably well Be Extra Plagued by French Uncertainties

France’s put up-election uncertainties comprise affected the remainder of Europe thru a likelihood-off market ambiance, as highlighted by earlier rises in funding costs for euro place sovereigns relative to Germany following President Macron’s decision to name early legislative elections. On the opposite hand, spillover throughout the euro place has to-date remained modest.

Figure 2: French politics in turmoil but euro-place spill-over modest up to now

10-twelve months benchmark bond, yields (%, RHS), unfold to the ten-twelve months German Bund (bps, LHS)

Severely, political and policy developments in France have a tendency to negatively comprise an affect on the scope and poke of the EU’s reform agenda, including developments in deepening the Single Market, the Capital Markets Union, and the scale and priorities of the next EU finances. The credibility of the EU’s no longer too long ago adopted fiscal framework may well well also also be tested by the policy priorities of the next French authorities.

For a seek the least bit of this day’s economic events, inspect our economic calendar.

Thomas Gillet is Director in Sovereign and Public Sector scores at Scope Scores GmbH and predominant sovereign analyst on France’s sovereign credit score score. Brian Marly, Senior Analyst at Scope and supporting analyst on France, contributed to drafting this statement.

In regards to the Author

Thomas Gillet is Associate Director in Scope’s Sovereign and Public Sector scores community, guilty for scores and learn on a alternative of sovereign borrowers. Before becoming a member of Scope, Thomas labored for Global Sovereign Advisory, a monetary advisory company essentially based utterly in Paris devoted to sovereign and quasi-sovereign entities.

Did you watch this text precious?

Most modern info and diagnosis

Commercial