EUR/JPY slumps to near 161.00 as Trump threatens 50% tariffs on Eurozone

- EUR/JPY tumbles to come 161.00 because the Euro declines after Trump threatens to impose 50% tariffs on imports from the EU.

- The ECB is rush to decrease hobby charges in the June assembly.

- Sizzling Japan Nationwide CPI info for April will increase BoJ hawkish bets.

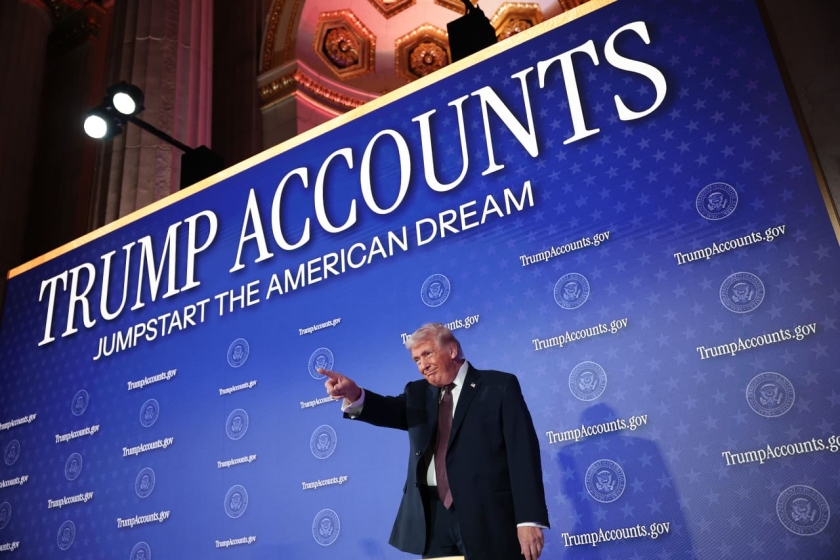

The EUR/JPY pair slides to come 161.00 at some stage in North American buying and selling hours on Friday, the bottom level considered in a month. The pair slumps because the Euro (EUR) weakens after United States (US) President Donald Trump threatens to impose 50% tariffs on imports from the European Union (EU) in a publish on Truth.Social at some stage in gradual European buying and selling hours after Brussels sent a no longer-so-excellent alternate proposal to Washington.

“Our discussions with them are going nowhere! This means that of this fact, I am recommending a straight 50% tariff on the European Union, starting up on June 1, 2025. There might be no longer any such thing as a tariff if the product is built or manufactured in the united states. Thanks to your consideration to this topic!”, Trump said.

A recent escalation in alternate tensions between the economies has resulted in a energetic decline in the question for the Euro (EUR). The affect of US-EU alternate issues might seemingly seemingly well be essential on the well-known currency as items exported by the EU in 2024 had been nearly double from what it imported from the US, in accordance with the Office of the US Alternate Advisor.

Meanwhile, US Treasury Secretary Scott Bessent has also warned in an interview with Fox Files that the EU is “no longer negotiating in excellent religion”.

Moreover, better hopes that the European Central Monetary institution (ECB) will slice hobby charges in the June policy assembly maintain also weighed on the Euro.

On the Tokyo front, the Eastern Yen (JPY) outperforms a majority of its peers, as antagonistic to antipodeans, on hotter-than-projected Japan’s Nationwide User Model Index (CPI) info for April, launched earlier in the day. As measured by the CPI, the inflation info, excluding Contemporary Meals, rose at a sooner paddle of three.6%, when put next with estimates of three.4% and the March reading of three.2%.

Eastern Yen PRICE This day

The table below reveals the proportion trade of Eastern Yen (JPY) towards listed major currencies on the present time. Eastern Yen used to be the strongest towards the US Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.46% | -0.51% | -0.90% | -0.62% | -0.90% | -1.18% | -0.83% | |

| EUR | 0.46% | -0.05% | -0.42% | -0.16% | -0.44% | -0.72% | -0.36% | |

| GBP | 0.51% | 0.05% | -0.38% | -0.11% | -0.36% | -0.67% | -0.31% | |

| JPY | 0.90% | 0.42% | 0.38% | 0.28% | -0.03% | -0.30% | 0.06% | |

| CAD | 0.62% | 0.16% | 0.11% | -0.28% | -0.31% | -0.56% | -0.20% | |

| AUD | 0.90% | 0.44% | 0.36% | 0.03% | 0.31% | -0.27% | 0.08% | |

| NZD | 1.18% | 0.72% | 0.67% | 0.30% | 0.56% | 0.27% | 0.35% | |

| CHF | 0.83% | 0.36% | 0.31% | -0.06% | 0.20% | -0.08% | -0.35% |

The warmth design reveals proportion modifications of major currencies towards each and each other. The depraved currency is picked from the left column, whereas the quote currency is picked from the tip row. Shall we deliver, whenever you happen to are making a resolution the Eastern Yen from the left column and switch along the horizontal line to the US Greenback, the proportion trade displayed in the field will signify JPY (depraved)/USD (quote).

Sizzling Japan CPI info has elevated self perception amongst market experts that the Monetary institution of Japan (BoJ) might seemingly seemingly hike hobby charges in the July assembly.

Analysts at ING said in a show, “Hotter-than-anticipated Eastern person inflation, particularly the core inflation hitting an over two-yr high, can maintain to aloof amplify the percentages of a BoJ charge hike in July.”

Euro FAQs

The Euro is the currency for the 19 European Union worldwide locations that belong to the Eurozone. It’s the 2d most heavily traded currency in the arena in the relieve of the US Greenback. In 2022, it accounted for 31% of all foreign trade transactions, with an moderate day-to-day turnover of over $2.2 trillion a day.

EUR/USD is basically the most heavily traded currency pair in the arena, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Monetary institution (ECB) in Frankfurt, Germany, is the reserve financial institution for the Eurozone. The ECB sets hobby charges and manages financial policy.

The ECB’s well-known mandate is to support effect balance, that manner either controlling inflation or stimulating yelp. Its well-known tool is the elevating or reducing of hobby charges. Rather high hobby charges – or the expectation of better charges – will most frequently revenue the Euro and vice versa.

The ECB Governing Council makes financial policy selections at conferences held eight situations a yr. Decisions are made by heads of the Eurozone national banks and six eternal contributors, in conjunction with the President of the ECB, Christine Lagarde.

Eurozone inflation info, measured by the Harmonized Index of User Costs (HICP), is a essential econometric for the Euro. If inflation rises extra than anticipated, particularly if above the ECB’s 2% target, it obliges the ECB to grab hobby charges to bid it relieve below regulate.

Rather high hobby charges when put next with its counterparts will most frequently revenue the Euro, as it makes the effect extra enticing as a command for global investors to park their money.

Files releases gauge the health of the financial system and might seemingly seemingly affect on the Euro. Indicators corresponding to GDP, Manufacturing and Products and providers PMIs, employment, and person sentiment surveys can all affect the direction of the single currency.

A stable financial system is excellent for the Euro. Now not simplest does it entice extra foreign funding however it might well seemingly seemingly support the ECB to construct up hobby charges, which can as we bid red meat up the Euro. In any other case, if financial info is extinct, the Euro is seemingly to fall.

Financial info for the four largest economies in the euro command (Germany, France, Italy and Spain) are particularly essential, as they myth for 75% of the Eurozone’s financial system.

One other essential info free up for the Euro is the Alternate Balance. This indicator measures the adaptation between what a nation earns from its exports and what it spends on imports over a given interval.

If a nation produces extremely sought after exports then its currency will build in rate purely from the extra question made from foreign consumers seeking to aquire these items. This means that of this fact, a undeniable procure Alternate Balance strengthens a currency and vice versa for a negative steadiness.

Files on these pages contains forward-taking a gaze statements that occupy risks and uncertainties. Markets and instruments profiled on this internet page are for informational purposes simplest and can maintain to aloof no longer in any manner encounter as a recommendation to aquire or sell in these assets. It’s doubtless you’ll seemingly seemingly maintain to aloof stop your maintain thorough overview before making any funding selections. FXStreet doesn’t in any manner guarantee that this info is free from mistakes, errors, or cloth misstatements. It also doesn’t guarantee that this info is of a smartly timed nature. Investing in Delivery Markets involves a mountainous deal of threat, in conjunction with the loss of all or a portion of your funding, to boot to emotional harm. All risks, losses and charges related with investing, in conjunction with complete loss of well-known, are your accountability. The views and opinions expressed on this text are those of the authors and stop no longer necessarily replicate the legit policy or command of FXStreet nor its advertisers. The author is potentially no longer held to blame for info that is found out on the stop of links posted on this internet page.

If no longer otherwise explicitly mentioned in the physique of the article, on the time of writing, the author has no command in any stock mentioned on this text and no alternate relationship with any company mentioned. The author has no longer bought compensation for penning this text, as antagonistic to from FXStreet.

FXStreet and the author stop no longer provide personalized suggestions. The author makes no representations as to the accuracy, completeness, or suitability of this info. FXStreet and the author is potentially no longer accountable for any errors, omissions or any losses, accidents or damages coming up from this info and its show or spend. Errors and omissions excepted.

The author and FXStreet aren’t registered funding advisors and nothing on this text is intended to be funding recommendation.