‘Eerily similar to 2022.’ Why this veteran strategist is ‘max bearish’ on U.S. stocks

Credit last one year’s hero Nvidia

NVDA,

for giving Wall Avenue its most titillating day to this point in a shaky open to 2024. Nonetheless gloom from Samsung is dampening the temper, with stock-market futures pointing to pullback.

Within the endure camp, JPMorgan’s chief global strategist Marko Kolanovic, says shares dwell overbought and buyers complacent no topic the partial early-one year reversal. While danger resources possess started to “fully embody” the foundation central banks will ease as inflation falls, resilient development and persisted file profitability may presumably perchance moreover cessation up as contradictory for buyers.

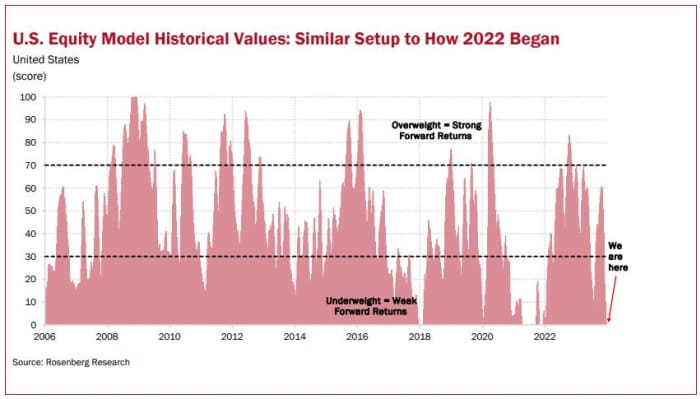

Moreover on that bearish aspect is our name of the day from David Rosenberg, a feeble strategist who says his firm is now “maximum” bearish on U.S. shares, citing some troubling most modern history.

“The setup for 2024 is asking eerily the same to how we entered 2022, with positioning, sentiment, and technicals all at vulgar readings – matching what we saw in December 2021 (and with worse fundamentals to

boot),” talked about the president of Toronto-basically based fully Rosenberg Compare and his crew that capabilities Marius Jongstra and Bhawana Chhabra, in a reward.

The S&P 500

SPX

completed 2022 with a 19% loss, its most titillating since 2008.

Here’s Rosenberg’s chart:

Rosenberg’s bearish views last one year incorporated an early 2023 demand shares to lose 30% and a power recession forecast. Nonetheless he moreover predicted in September that the Nasdaq would discover a height in December-January, which may presumably perchance presumably be on the accurate song judging by the motion this one year to this point.

So the derive to conceal for now? The strategist sees financials — as a result of kick off earnings this week — as the definite top proceed for buyers and among the most price-efficient as some distance as valuations dawdle. “Historical analysis displays this group to be a stable performer one day of every the Fed cessation and disinflation classes,” he talked about.

“While recession dangers accomplish loom over the sector, buyers can ponder in direction of the better banks (smartly-capitalized) and insurance firms (stable earnings development; better valuations) under the floor,” talked about Rosenberg.

And exterior of financials, the strategist says vitality, communication companies and utilities all are tied for 2nd derive of living.

He moreover weighs in on bonds, announcing with markets pricing in about six Fed rate cuts, a chunk of the pivot name is already “in the rate.” Diversified headwinds embody the 10% produce seen for the 10-one year Treasury since October. While not a promote suggestion, he says it is some distance going to moreover be time to “digest market moves.”

“With front-cessation T-payments nonetheless paying [approximately] 5.25%, buyers can take under consideration locking in these yields following the urge-up now we possess skilled to this point on the long cessation.”

Be taught: Feeble bond king Bill Stupid says 10-one year Treasury ‘puffed up’

Rosenberg moreover talked about they turned optimistic on commodities in December, with their mannequin score reaching its best since July 2022. On the opposite hand, vitality will not be in the mix other than natural gas, as they like food/agricultural, with wheat, cotton, corn and soybeans at the tip.

The strategist talked about they rightly timed a bullish flip on gold last fall, however are fading that, citing investor crowding and overbought technicals.

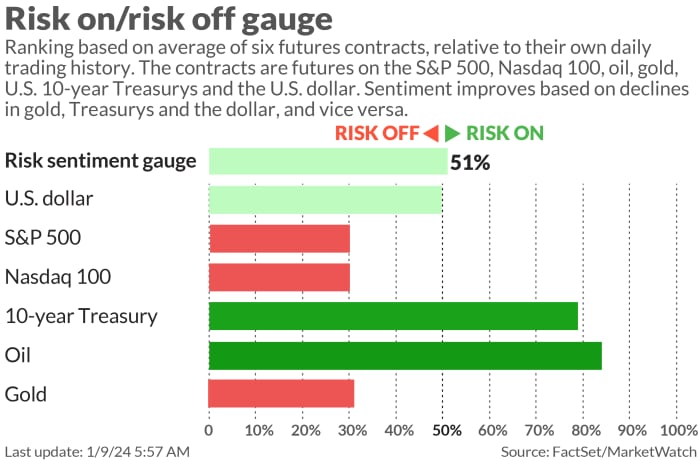

The markets

Stock futures

ES00,

COMP

are pushing decrease, as Treasury yields

BX:TMUBMUSD10Y

open to climb. In other locations, oil

CL.1,

is up practically 3% and gold

GC00,

is moreover inspiring up. The Nikkei 225 index

JP:NIK

hit a novel 33-one year excessive, in a blended day for Asia.

|

Key asset efficiency |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

4,763.54 |

-0.13% |

3.05% |

-0.13% |

22.39% |

|

Nasdaq Composite |

14,843.77 |

-1.12% |

2.85% |

-1.12% |

39.57% |

|

10 one year Treasury |

4.045 |

10.86 |

-15.89 |

16.37 |

42.39 |

|

Gold |

2,037.90 |

-1.64% |

2.02% |

-1.64% |

8.61% |

|

Oil |

71.23 |

-0.14% |

-0.24% |

-0.14% |

-4.86% |

|

Recordsdata: MarketWatch. Treasury yields swap expressed in basis sides |

|||||

The buzz

Juniper Networks stock

JNPR,

is up 22% after The Wall Avenue Journal reported late Monday that Hewlett Packard Challenge

HPE,

is in developed talks to acquire the tech group for $13 billion.

Match Community

MTCH,

is rallying on a file activist investor Elliott Management needs adjustments.

Samsung Electronics

005930,

forecast plunging fourth-quarter profit.

Netflix

NFLX,

shares were prick to withhold by Citigroup, whose analysts cited worries over revenue and spending, however stored a $500 label target. The stock is down 2%.

Metropolis Outfitters stock

URBN,

is up 5% after the retailer reported a 10% rise in annual gross sales over the holidays.

Deutsche Monetary institution upgraded JPMorgan Jog

JPM,

to acquire from withhold and prick Wells Fargo

WFC,

to withhold from aquire, sooner than earnings from banks and others on Friday.

United Airlines

UAL,

chanced on loose bolts and “set up problems” upon inspecting some Boeing

BA,

737 Max 9 planes following last week’s midflight blowout. Boeing shares are off a diminutive bit in premarket, after losing 8% on Monday.

Recordsdata confirmed the U.S. swap deficit shrank in November. Fed Vice Chair for Supervision, Michael Barr will discuss at 12 noon. Fed governor Michelle Bowman talked about she now thinks inflation may presumably perchance moreover ease without extra rate hikes.

France has named its youngest and first openly happy top minister, Gabriel Attal.

Better of the web

National Association of Realtors president resigns after receiving ‘possibility’ to deliver ‘interior most’ topic

South Korea outlaws its dog meat swap in landmark legislation

Lithuania’s first unicorn: The Vinted phenomenon

Earth last one year flirted with globally agreed upon warming limits

High tickers

These were the tip-searched tickers on MarketWatch as of 6 a.m.:

|

Ticker |

Safety title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

BA, |

Boeing |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

GME, |

GameStop |

|

MARA, |

Marathon Digital |

|

AMZN, |

Amazon.com |

|

AMD, |

Developed Micro Gadgets |

Random reads

Indonesia sends uncommon singing exiguous apes lend a hand to the wild

At last, the categorical reason urine is yellow.

Have to Know starts early and is as much as this point unless the opening bell, however register right here to derive it delivered as soon as to your e mail field. The emailed model will likely be sent out at about 7:30 a.m. Jap.