Dow Jones Industrial Average tilts further into the green on Friday

- The Dow Jones climbed into 46,250 on Friday, including one other bullish day on the backend.

- Equities beget risen after the Fed trimmed pastime charges thru the midweek.

- Coming up next week: PMI test outcomes and one other round of PCE inflation data.

The Dow Jones Industrial Moderate (DJIA) chalked in a single other slim but decisive build on Friday, bringing the main equity index’s weekly efficiency to around a plump proportion level build. The Dow Jones has climbed into document highs on the help of the Federal Reserve’s (Fed) most up-to-date payment minimize, and investors are positioning themselves for a chain of consecutive note-up cuts thru the pause of the yr.

Dow climbs on Fed enhance

The Dow Jones has to this level assign in a stellar efficiency, namely for insensible in the third quarter. While September is fundamentally a mild season for equities, this September has bucked the style. The Dow Jones is up over 1.6% for the month, marking in a string of high-water marks, and is on tempo to shut in the golf green for a fifth straight month.

Most sectors are on the high side for Friday, with tech stocks taking their frequent discipline on the entrance of the pack, hiking 0.72% for the day. Person discretionary stocks took 2d discipline, rising around 0.5%, while energy stocks suffered a decline of around 1.Forty five%.

Fresh batch of inflation data in the pipe

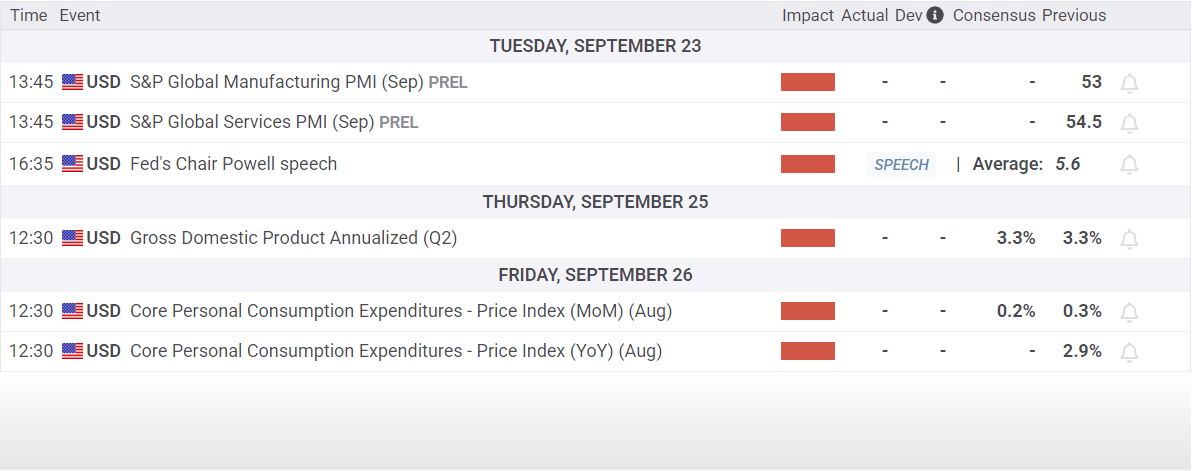

With the Fed’s long-awaited preliminary pastime payment minimize finally in the books, traders will deserve to pivot help to data looking at next week. Basically the most up-to-date round of S&P Global Buying Managers Index (PMI) test outcomes are due next Tuesday; US Mistaken Home Product (GDP) increase is scheduled for next Thursday; and an update to US Non-public Consumption Expenditures Brand Index (PCE) inflation is slated for next Friday.

Dow Jones day-to-day chart

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Buying Managers Index (PMI), launched on a monthly foundation, is a leading indicator gauging industry exercise in the US manufacturing sector. The knowledge is derived from surveys of senior executives at non-public-sector companies from the manufacturing sector. See responses replicate the trade, if any, in the hot month when put next to the outdated month and might perhaps per chance await changing trends in official data sequence much like Mistaken Home Product (GDP), industrial manufacturing, employment and inflation. A studying above 50 indicates that the manufacturing economic system is mostly increasing, a bullish designate for the US Dollar (USD). Within the meantime, a studying under 50 signals that exercise in the manufacturing sector is mostly declining, which is viewed as bearish for USD.

Learn more.

Next originate:

Tue Sep 23, 2025 13:Forty five (Prel)

Frequency:

Month-to-month

Consensus:

–

Outdated:

fifty three

Provide:

S&P Global

Information on these pages comprises ahead-attempting statements that involve dangers and uncertainties. Markets and instruments profiled on this web page are for informational capabilities most effective and might perhaps per chance per chance no longer in any formulation locate as a recommendation to aquire or promote in these property. You must peaceful perform your possess thorough analysis sooner than making any investment choices. FXStreet would now not in any formulation bid that this data is free from mistakes, errors, or field topic misstatements. It furthermore would now not bid that this data is of a successfully timed nature. Investing in Launch Markets involves a huge deal of probability, including the inability of all or half of your investment, as well to emotional hurt. All dangers, losses and charges linked to investing, including complete lack of fundamental, are your accountability. The views and opinions expressed listed right here are these of the authors and perform no longer necessarily replicate the official policy or build of FXStreet nor its advertisers. The author might perhaps per chance per chance no longer be held to blame for data that is chanced on on the pause of hyperlinks posted on this web page.

If no longer in every other case explicitly mentioned in the physique of the article, on the time of writing, the author has no build in any inventory mentioned listed right here and no industry relationship with any company mentioned. The author has no longer bought compensation for scripting this article, as adversarial to from FXStreet.

FXStreet and the author perform no longer present customized solutions. The author makes no representations as to the accuracy, completeness, or suitability of this data. FXStreet and the author might perhaps per chance per chance no longer be accountable for any errors, omissions or any losses, injuries or damages bobbing up from this data and its display veil or spend. Errors and omissions excepted.

The author and FXStreet are no longer registered investment advisors and nothing listed right here is supposed to be investment recommendation.