Dow Jones Industrial Average rebounds after PCE inflation print keeps rate cut hopes alive

- The Dow Jones rebounded over 350 ingredients on Friday, hiking support above 46,000.

- Fed rate lower expectations are peaceful heading within the appropriate route after PCE inflation met market forecasts.

- No topic a coolish print, inflation continues to retain on the inappropriate side of the Fed’s 2% annual goal.

The Dow Jones Industrial Life like (DJIA) rebounded on Friday, paring away the midweek’s losses and getting better footing as patrons self-soothe over odds of a notice-up ardour rate lower in October. US Non-public Consumption Expenditures Designate Index (PCE) inflation came in about where median market forecasts predicted, keeping market hopes for an October rate orderly on the excessive side.

Inflation holds regular, keeping rate lower bets on steadiness

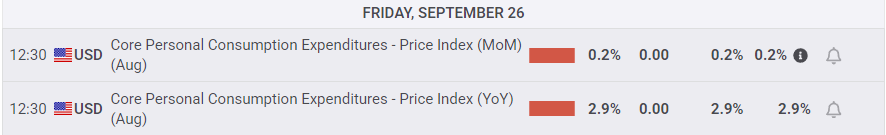

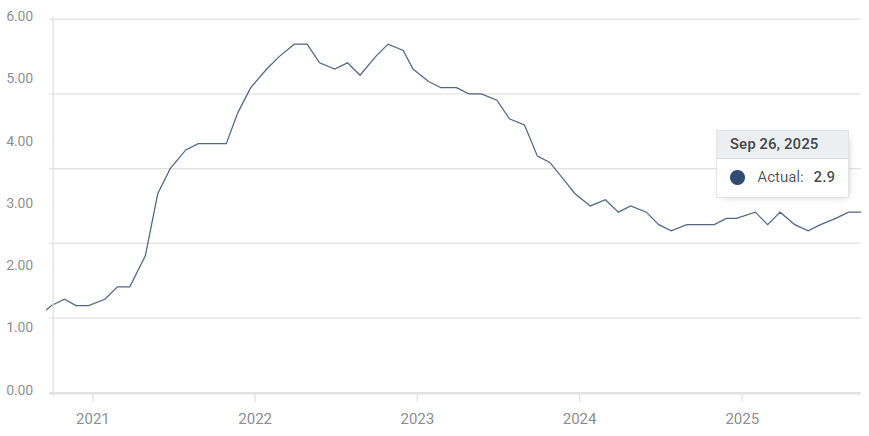

Core PCE inflation held regular at 2.9% on an annual foundation, meeting market forecasts. The month-to-month decide also held flat at 0.2% MoM, while headline PCE inflation accelerated to 0.3% MoM and a pair of.7% YoY. The US financial system is now eight months into its “one-time inflation passthrough” from the Trump administration’s tariffs, and core annual PCE inflation metrics are on the a similar stage they had been virtually 18 months within the past in March of 2024.

No topic the inability of meaningful development on inflation, markets are peaceful leaning into the bullish side as Friday’s PCE inflation print was no longer excessive ample to spark any considerations relating to the Fed falling support into hawkish territory. Amid a slumping labor market, the Fed is peaceful heading within the appropriate path to bring a second straight quarter-level ardour rate lower on October twenty fifth. Per the CME’s FedWatch Instrument, rate merchants are pricing in virtually 90% odds that the Fed will bring a 25 bps rate orderly to envision the outlet rate lower from September’s rate meeting.

Core PCE inflation, YoY

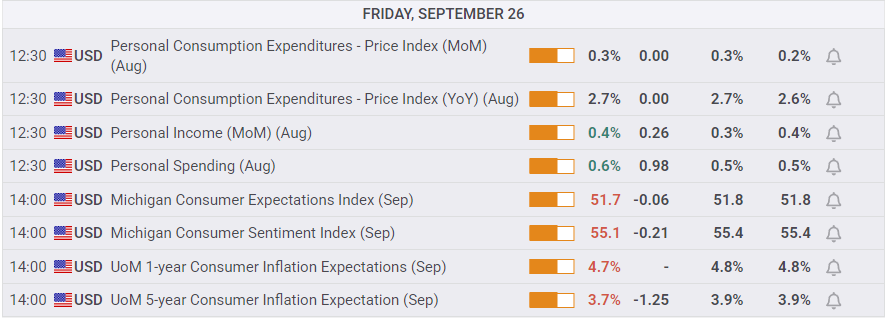

Non-public Earnings and Non-public Spending every rose in August, hiking to 0.4% and 0.6%, respectively. Whereas rising profits and consumption metrics are obvious indicators for the US financial system, accelerating wage pressures might well well well bolster inflation metrics in some unspecified time in the future, complicating the Fed’s path to a unique rate-slicing cycle.

Shopper sentiment eases a puny bit of, nonetheless a lot of labor peaceful on the cards

September’s College of Michigan (UoM) Shopper Expectations and Sentiment Indexes every declined a puny bit of from the previous month, nonetheless again, the options was mostly consistent with market expectations. UoM 5-year and 5-year Shopper Inflation Expectations also ticked lower in September, nonetheless the topline figures are peaceful using excessive at 4.7% and 3.7%, respectively.

Customers believe a solid tendency to overshoot practical outcomes, nonetheless such consistently excessive figures over time would be a warning of overly label-sensitive customers’ inflation expectations changing into entrenched in a self-gratifying prophecy. So long as customers proceed to build a query to above-saunter inflation, agencies might well be extra inclined to meet those expectations.

Dow Jones on every day foundation chart

Economic Indicator

Core Non-public Consumption Expenditures – Designate Index (YoY)

The Core Non-public Consumption Expenditures (PCE), released by the US Bureau of Economic Prognosis on a month-to-month foundation, measures the adjustments within the costs of goods and services and products bought by customers within the United States (US). The PCE Designate Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY studying compares the costs of goods within the reference month to the a similar month a year earlier. The core studying excludes the so-known as extra unstable meals and energy parts to present a extra upright measurement of label pressures.” Customarily, a excessive studying is bullish for the US Buck (USD), while a low studying is bearish.

Learn extra.

After publishing the GDP memoir, the US Bureau of Economic Prognosis releases the Non-public Consumption Expenditures (PCE) Designate Index recordsdata alongside the month-to-month adjustments in Non-public Spending and Non-public Earnings. FOMC policymakers exhaust the annual Core PCE Designate Index, which excludes unstable meals and energy costs, as their critical gauge of inflation. A stronger-than-anticipated studying might well well well support the USD outperform its competitors because it would imprint at a imaginable hawkish shift within the Fed’s ahead steerage and vice versa.

Files on these pages comprises ahead-attempting statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational functions most attention-grabbing and might well peaceful no longer in any attain come across as a advice to amass or promote in these resources. It is possible you’ll well well additionally peaceful raise out your believe thorough research earlier than making any funding decisions. FXStreet doesn’t in any attain guarantee that this recordsdata is free from mistakes, errors, or fabric misstatements. It also doesn’t guarantee that this recordsdata is of a timely nature. Investing in Originate Markets entails a colossal deal of chance, including the loss of all or a portion of your funding, besides as emotional wretchedness. All risks, losses and costs associated with investing, including total loss of critical, are your accountability. The views and opinions expressed listed listed right here are those of the authors and lift out no longer necessarily replicate the legit policy or region of FXStreet nor its advertisers. The creator is potentially no longer held accountable for recordsdata that is found on the stop of links posted on this page.

If no longer in any other case explicitly talked about within the body of the article, on the time of writing, the creator has no region in any stock talked about listed right here and no commerce relationship with any company talked about. The creator has no longer bought compensation for penning this article, rather then from FXStreet.

FXStreet and the creator raise out no longer provide personalized ideas. The creator makes no representations as to the accuracy, completeness, or suitability of this recordsdata. FXStreet and the creator is potentially no longer responsible for any errors, omissions or any losses, accidents or damages coming up from this recordsdata and its present or exhaust. Errors and omissions excepted.

The creator and FXStreet are no longer registered funding advisors and nothing listed right here is intended to be funding advice.