Check in on seasonality

It’s gigantic to be assist writing the Chart Advisor once more all this week! Plenty has changed since my week in October, and this might maybe moreover moreover be relaxing to continue on this hunch.

1/ Seasonality

One among my accepted ways to initiating the week is to register on Seasonality. The chart beneath illustrates the S&P 500’s efficiency over the final 25 years, specifically all around the main one year of the presidential cycle, for the seven most indicate US presidents. Whereas that’s now no longer a tall sample size, a wide quantity of eventualities and economic backdrops own tended to act a small bit equally. And to this level, 2025 is following this playbook remarkably nicely.

Seasonality appears on the in vogue hotfoot of an index, inventory, and deal of others., on a given day over the closing X quantity of periods. For this example, I’m the closing 7 years of the S&P 500 Index, but finest all around the main one year of a US presidential term.

I secure that once seasonality and pattern agree, excellent things can occur. It’s price a look now after which.

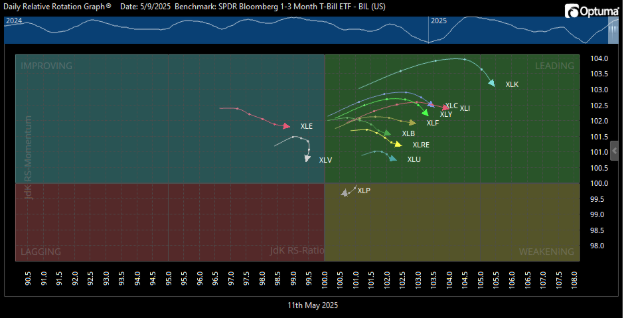

2/ RRG – Staring on the ducks going around the pond

Next up is a study how the sectors of the S&P 500 are appearing relative to T-Bills the usage of RRG (Relative Rotation Graphs) created by Julius de Kempenaer. I love to consult with this as looking on the “ducks bolt around the pond,” because the sectors will are inclined to rotate in a clockwise circle around the graph.

As of Friday, most sectors of the powerful index own moved nicely into the Green (Leading) field. And that’s gigantic! Just a few weeks within the past, they were all clustered within the Crimson (Lagging) field, which is the put market rallies are inclined to initiating. But now, the sectors are taking a look drained: the arrows are initiating to level downward in direction of the Yellow (Weakening) field. Whereas that isn’t a clear sell signal, it’s miles a situation to listen in on.

Re-reference the Seasonality chart above and there appears to be a keen tumble in some unspecified time in the future in mid-Would possibly per chance maybe per chance also just. If the S&P 500 sectors initiating as much as roll over and push downward, then I’d search recordsdata from a pullback to initiating. But for now, we restful own to see and wait. We’ll revisit this a pair of times this week to see it play out.

XLP (Person Staples) is already heading in direction of the exit, and XLV (Healthcare) appears as if this can skip the Green field and bolt straight assist into Crimson. And blueprint up within the pause gorgeous – XLK (Technology) is turning over faster than many deal of sectors. That tends to keen the ground in both rallies and pullbacks. So withhold an survey on that one.

I submit these on Twitter every Friday so you would moreover see the “ducks” swim their laps.

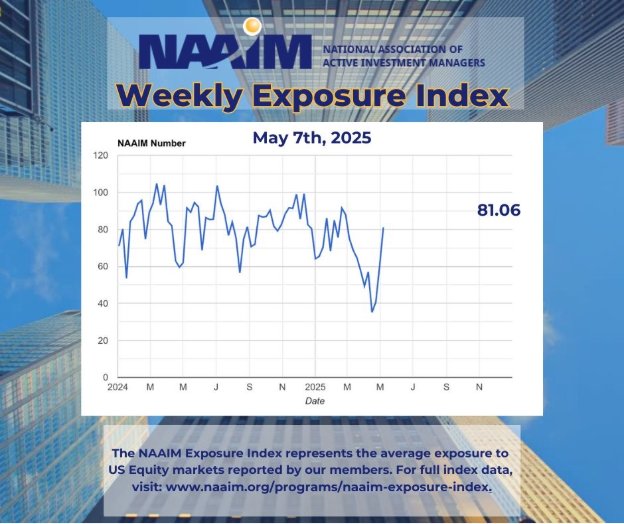

3/ I’ve been a protracted-time contributor to the NAAIM Publicity Index and secure it beneficial to review my leer of the market to that of assorted monetary professionals. It signifies to me how powerful relative conviction I own vs. assorted active managers in exhibiting how powerful equity publicity is allocated to the market at a given time. It might maybe well even be beneficial as a contrarian indicator in some instances.

Closing week, the Publicity Index had a gigantic rebound, assist up above 80 – a usual reading for an up-trending market. Now not too long within the past, this index has been lagging within the assist of in catching as much as the market rebound. But hiya, don’t see at me; I’ve been reporting numbers loyal over 100 all around the previous couple of weeks, a ways exceeding the consensus of this neighborhood.

I also continuously be pleased Rob Hanna’s work (Quantifiable Edges), which shows that a NAAIM Index pullback into the 40 space can correspond to a short-term rebound rally over the following week or two. But once more, it’s miles now no longer a signal, but a situation. Discover your setups and swap accordingly.

To sum up the scenario going into this week: Seasonality suggests warning and the ability for a short tempo bump ahead. Most S&P 500 sectors appear to agree that this tournament might maybe moreover occur in some unspecified time in the future this week. On the a lot of hand, in vogue sentiment does seem like making improvements to, and it’s excellent to seem at assorted managers within the kill discover up on this pattern. I’m optimistic but cautious going into this week, as within the kill, the market restful does whatever it wants.

Free up challenging gold and silver trading indicators and updates that most traders don’t survey. Be half of our free publication now!

The views and opinions expressed within the posts of the CMT Affiliation are these of the authors and build now no longer primarily think the decent policy or design of the CMT Affiliation. The knowledge offered is for in vogue informational options finest and is now no longer meant as investment advice. The CMT Affiliation doesn’t supply investment administration or investment advisory products and services of any type. The association strives to withhold the finest standards of decent competence and ethics amongst its contributors, who’re required to abide by the Code of Ethics and Requirements of Legit Habits.