Can Curve Finance Catch Its Hacker? $1.85M Bounty Now For Public Assistance

Following a breach on July 30, Curve Finance has grew to change into to the public with a $1.85 million bounty in hopes of retrieving stolen property.

Curve Finance, a decentralized finance protocol, announced that the $1.85 million bounty to enhance funds misplaced at some stage in a reentrancy exploit on July 30 is now supplied to the public.

The breach, attributed to a weakness in the Vyper neat contract language for Ethereum Virtual Machine, resulted in wary buyers pulling out a prime $3 billion from a number of DeFi platforms.

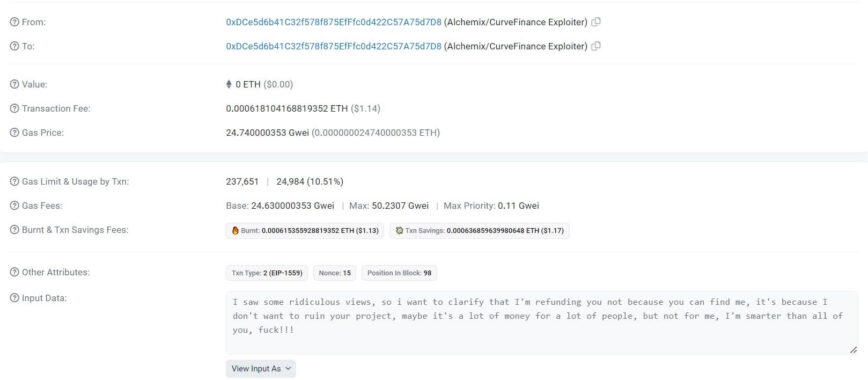

No matter Curve Finance’s prior proposal to the attacker of a 10% bounty in replace for the return of stolen funds, simplest a fraction used to be returned to platforms, at the side of Alchemix, by Aug. 5.

In mild of this, and with the Aug. 6 time limit passing with out any additional returned property, Curve Finance extended the bounty offer to most other folks. Cruve tweeted that the hacker of the CRV/ETH protocol didn’t return the comfort of the funds, so the bounty will lag to other folks who are ready to title the hacker in uncover to pursue apt accelerate.

On the radiant side, blockchain evaluation by Peckshield confirmed a silver lining: about 73% of the stolen property had been returned by Aug. 7. The DeFi neighborhood witnessed moral hackers, relish c0ffeebabe.eth, stepping in and returning sizable amounts to initiatives, corresponding to Metronome and Curve’s procuring and selling pool.

#PeckShieldAlert A entire of ~$73.5M price of cryptos on #Ethereum were stolen in the #Curve Reentrancy exploit. So a ways, ~73% of them (~$52.3M) enjoy been returned.

The final ~$19.7M price of cryptos on #Ethereum enjoy now now not yet been returned by the 1st Curve CRV-ETH exploiter… pic.twitter.com/hU4v1UATeh

— PeckShieldAlert (@PeckShieldAlert) August 7, 2023

Other DeFi platforms are exhibiting caution relating to Curve’s CRV token. On Aug. 6, the Aave neighborhood celebrated a accelerate to ban additional CRV borrowing on their platform, a transfer made to quit capacity liquidation risks, especially concerned with Curve founder Michael Egorov’s considerable CRV-backed debt.

Within the meantime, Abracadabra Cash proposed a 200% interest rate hike to mitigate the risks to its CRV cauldrons, which could per chance plight off MIM to be uncovered to collateralization risks:

“We’re suggesting to enlarge the interest rate in uncover to chop Abracadabra’s entire CRV exposure to round $5M borrowed MIM.”

Recordsdata from Lookonchain printed Egorov had traded a prime 142.6 million CRV tokens, a corresponding to $57 million, in over-the-counter affords to a vary of entities. Egorov’s well-known debt still hovers round $49 million at some stage in a pair of DeFi platforms.

Replace:

The #Curvefi founder(Michale Egorov) sold a entire of 142.6M $CRV to 30 institutions/buyers by OTC at a heed of $0.4 and obtained $57M to repay the money owed.

He presently has 269.8M $CRV($166M) in collateral and $forty eight.7M in debt on 4 platforms.https://t.co/8ozY1y5KrO pic.twitter.com/ITA08Fuf4f

— Lookonchain (@lookonchain) August 6, 2023

The knowledge on or accessed through this web page is got from fair sources we believe to be loyal and legit, but Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any knowledge on or accessed through this web page. Decentral Media, Inc. is now now not an funding advisor. We invent now now not give personalized funding advice or varied monetary advice. The knowledge on this web page is self-discipline to replace with out search. Some or all of the positive guess on this web page could per chance became older-long-established, or it can be or change into incomplete or incorrect. We would, but are now now not obligated to, replace any outdated-long-established, incomplete, or incorrect knowledge.

You can enjoy to never compose an funding decision on an ICO, IEO, or varied funding according to the positive guess on this web page, and you’ll be in a position to enjoy to never define or otherwise depend upon any of the positive guess on this web page as funding advice. We strongly imply that you just search the advice of a licensed funding advisor or varied qualified monetary legit when that you just’ll want to doubtless be in the hunt for funding advice on an ICO, IEO, or varied funding. We invent now now not accept compensation in any abolish for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Explore rotund terms and conditions.