Bitcoin soars above $84,000 as US inflation cools in February

Markets

Residence » Markets » Bitcoin soars above $84,000 as US inflation cools in February

by

Vivian Nguyen

Mar. 12, 2025

Fed Chair beforehand indicated that the central bank is now not at risk of lower pastime rates within the strategy time length.

Characterize: Adam Gray

Key Takeaways

- US inflation in February confirmed a lower, with annual CPI shedding to 2.8% from the previous 3%.

- Economists warn that Trump’s tariffs would possibly perhaps well perhaps also reverse the cooling inflation building and result in extra tag hikes.

Share this article

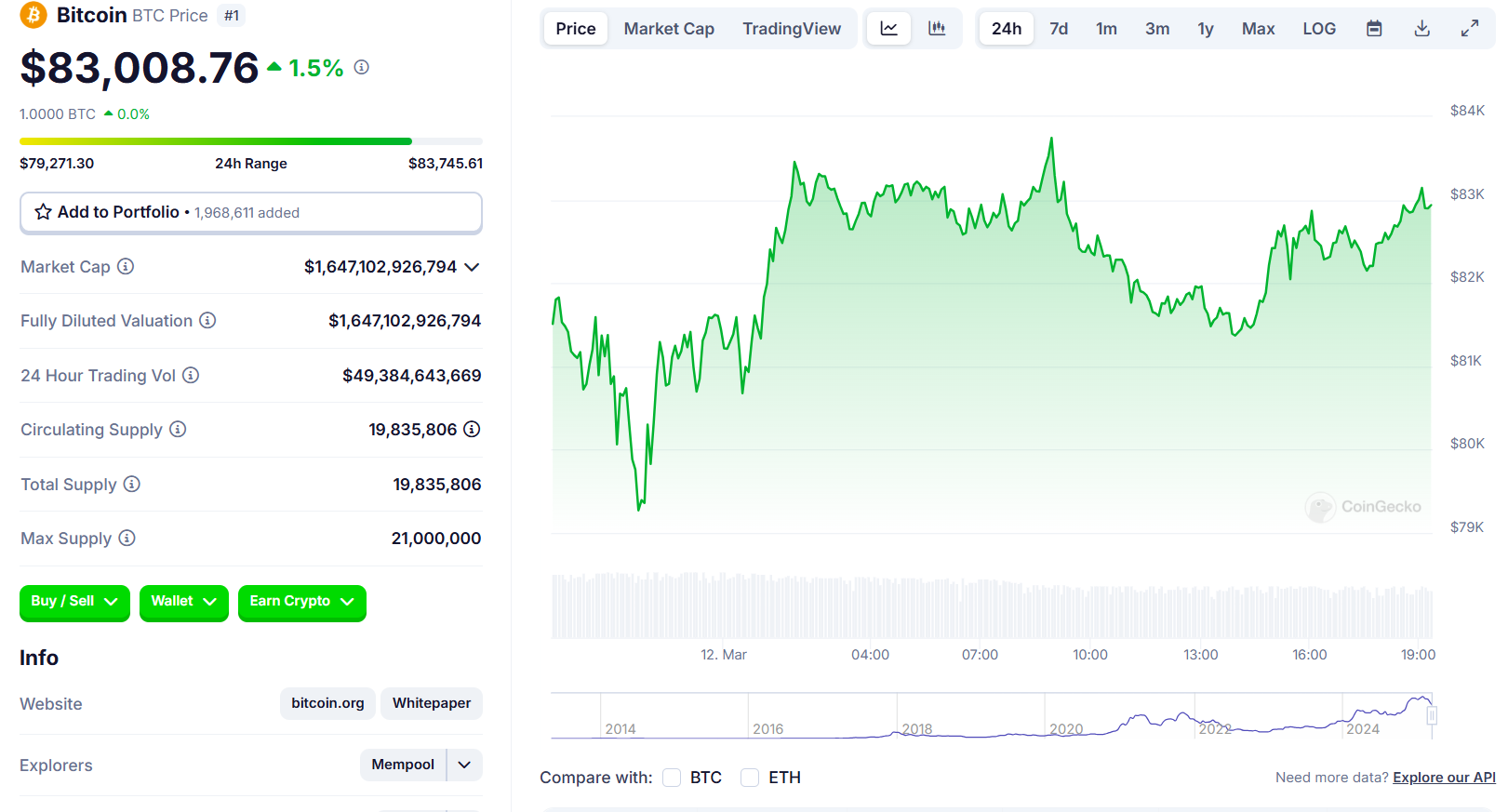

Client prices rose 0.2% in February from January, basically based on unique CPI data launched Wednesday, bringing annual inflation to 2.8%—a decline from 3% within the previous month. Bitcoin spiked above $84,000 in accordance with the lower-than-anticipated data.

Core CPI, which excludes volatile meals and power prices, elevated 0.2% month-over-month, with the annual fee settling at 3.1%, under January’s 3.3%.

On the opposite hand, economists warn that President Trump’s tariff policies would possibly perhaps well perhaps also wait on prices elevated within the months forward.

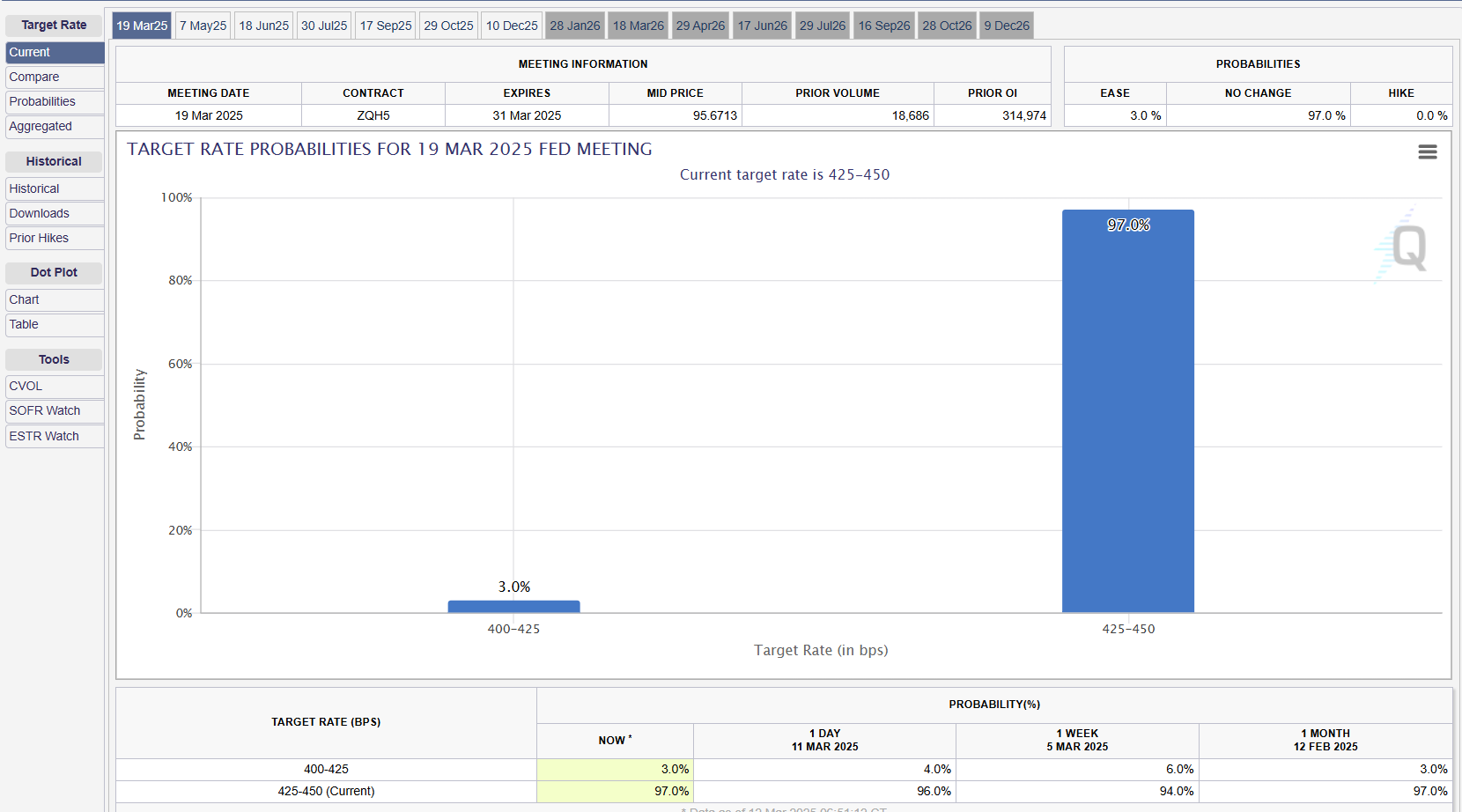

The inflation report comes as markets widely query the Fed to wait on rates true within the strategy time length. As of the most up-to-date data from CME Group’s FedWatch tool, traders were pricing in a low chance of a fee lower on the central bank’s meeting next week.

Fed Chair Jerome Powell warned final Friday that Trump’s enacted and proposed tariffs would possibly perhaps well perhaps also result in a chain of tag increases, doubtlessly causing customers to wait for higher inflation.

The inflation fee looks to have stalled after previous declines, final stubbornly above the Fed’s target. While lengthy-time length inflation expectations have stayed fairly stable, temporary expectations have elevated, partly attributable to tariff considerations, basically based on Powell.

The Fed, which had been imposing fee cuts, has paused its financial policy changes, maintaining the federal funds fee true at 4.25%-4.5%.

Except inflation clearly aligns with the Fed’s target, the Fed will wait on a staunch financial policy. This would possibly perhaps well perhaps also wait on Bitcoin prices volatile as traders weigh the ability for future fee cuts in opposition to ongoing financial uncertainty.

Bitcoin’s observed resilience to temporary macroeconomic shifts means that its tag would possibly perhaps well perhaps now not be heavily influenced completely by inflation data. But, total financial prerequisites and investor sentiment can gentle influence its value.

Bitcoin traded above $83,000 sooner than the inflation data release, bettering from a recent dip under $80,000. The crypto asset has won 1.5% within the final 24 hours, per CoinGecko data.

Share this article