Bitcoin (BTC) Price Prediction: Top Analyst Points to Possible $200,000 Target in Q4

TLDR

- Bitcoin reached $119,450 on October 2, its best assign in seven weeks since August 14

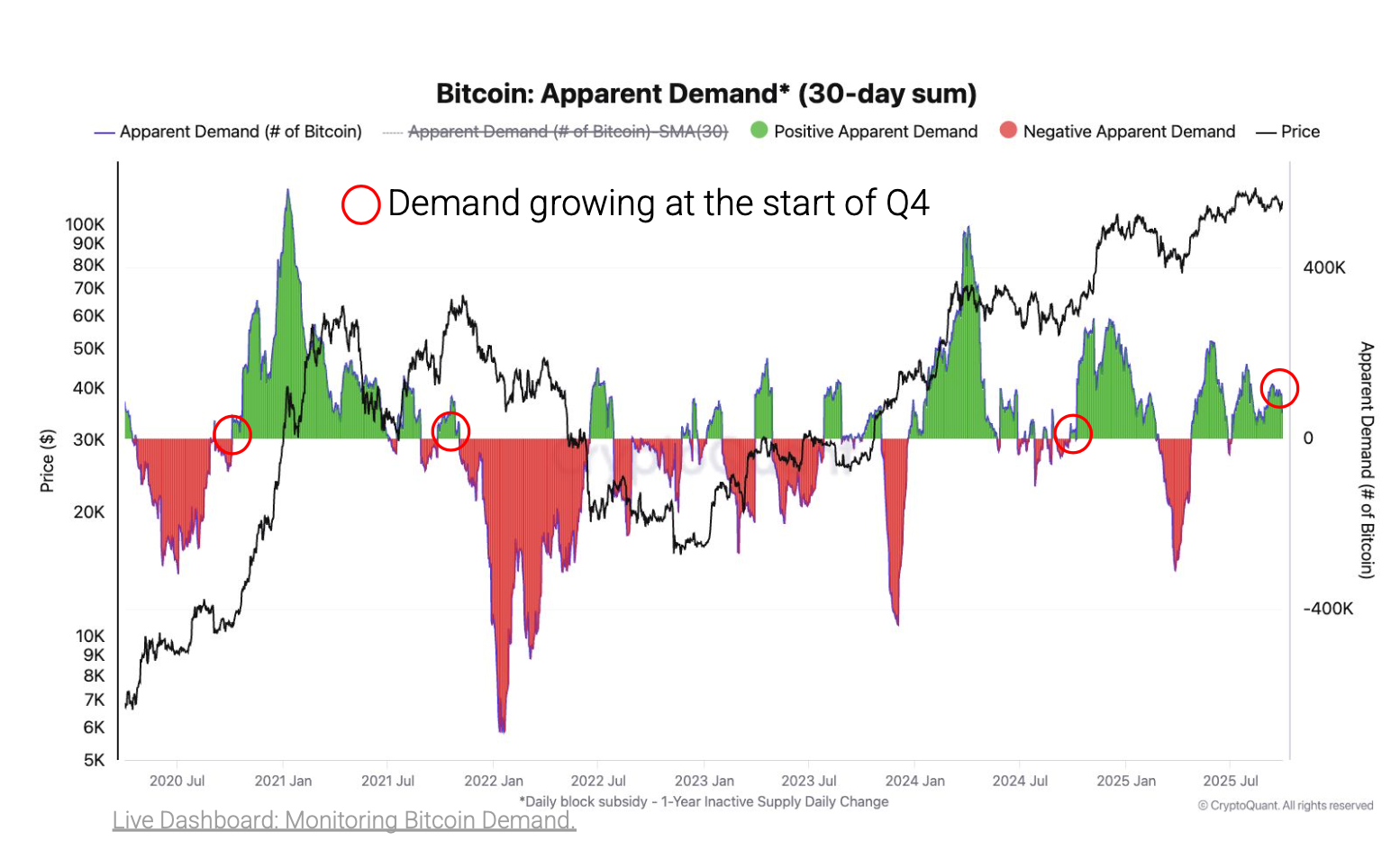

- CryptoQuant forecasts Bitcoin might per chance most likely well per chance attain $160,000 to $200,000 by the stay of Q4 2025 if modern ask patterns continue

- Monthly assert ask for Bitcoin has been increasing by extra than 62,000 BTC since July 2025

- US labor market details showing weakness has elevated the likelihood of Federal Reserve fee cuts to Ninety nine% for the October 29 meeting

- Whale holdings are expanding at an annual fee of 331,000 BTC, larger than old fourth quarter periods

Bitcoin climbed 4% over 24 hours to prevail in $119,450 on Coinbase all thru early shopping and selling on October 2. This marked the cryptocurrency’s best assign level since August 14, seven weeks earlier.

The worth surge pushed Bitcoin above the $117,500 resistance diploma. The digital asset now faces resistance at the $120,000 assign.

The rally elevated complete crypto market capitalization by 3.5% to $4.16 trillion. Bitcoin’s market cap reached $2.37 trillion, inserting it above Amazon’s valuation primarily based mostly on CompaniesMarketCap.

October has traditionally been Bitcoin’s strongest month. The cryptocurrency has posted beneficial properties in 10 of the past 12 Octobers primarily based mostly on CoinGlass details.

US job opening details from August confirmed a marginal carry whereas hiring declined. The Bureau of Labor Statistics released these figures this week.

The labor market details supports expectations for further Federal Reserve fee cuts. CME futures prediction markets now uncover a Ninety nine% likelihood of a 0.25% fee lower at the Fed’s October 29 meeting, up from 96.2% on Monday.

Fourth Quarter Rate Projections

CryptoQuant released prognosis pointing out Bitcoin entered Q4 2025 below favorable conditions for a assign rally. The onchain analytics firm projects a assign fluctuate of $160,000 to $200,000 by year’s stay if ask bellow continues.

Space ask for Bitcoin has been rising since July. Obvious ask has been increasing at a monthly lunge exceeding 62,000 BTC primarily based mostly on CryptoQuant.

This ask sample fits conditions that preceded old fourth quarter rallies in 2020, 2021, and 2024. Whale holdings are expanding at an annual fee of 331,000 BTC.

This compares to 255,000 BTC in Q4 2024 and over 238,000 at the start of Q4 2020. US-listed ETFs bought 213,000 BTC in Q4 2024, representing a 71% carry from the old quarter.

THEY’RE BUYING. HARD. 🔥#BITCOIN SPOT ETFS SAW $429.9M INFLOWS (3,762 BTC) YESTERDAY.

NOT ONE ETF HAD AN OUTFLOW. pic.twitter.com/mxotz6zusA

— Carl Moon (@TheMoonCarl) October 1, 2025

Save aside a matter to Indicators Make stronger Bullish Case

Bitcoin broke above the trader’s on-chain realized assign of $116,000. CryptoQuant identifies this as the threshold for transferring wait on into the bull section of the cycle.

CryptoQuant’s bitcoin bull earn index stood at 40-50 in late September. These ranges matched readings from the stay of Q3 2024, sooner than Bitcoin rallied from $70,000 to $100,000.

The index has been supported by increasing Bitcoin ask and expanding stablecoin liquidity. Decrease unrealized trader beneficial properties impress reduced promoting stress primarily based mostly on the firm.

Standard Chartered Bank, Bitwise, and Fundstrat’s Tom Lee have also issued forecasts for Bitcoin reaching $200,000 by year stay. Standard Chartered projects Bitcoin might per chance most likely well per chance attain $500,000 by 2028.

Different cryptocurrencies also posted beneficial properties on October 2. Ethereum rose extra than 5% to prevail in $4,390, its best diploma since September 22.

Solana, Dogecoin, Cardano, Chainlink and Hyperliquid all elevated extra than 6% all thru the identical interval. On the time of reporting, Bitcoin had retreated a small to $118,947 after reaching the seven-week excessive.