AMZN Elliott Wave technical analysis [Video]

![AMZN Elliott Wave technical analysis [Video]](https://www.tipsnews.info/wp-content/uploads/2025/06/107390-amzn-elliott-wave-technical-analysis-video.jpg)

AMZN Elliott Wave technical prognosis

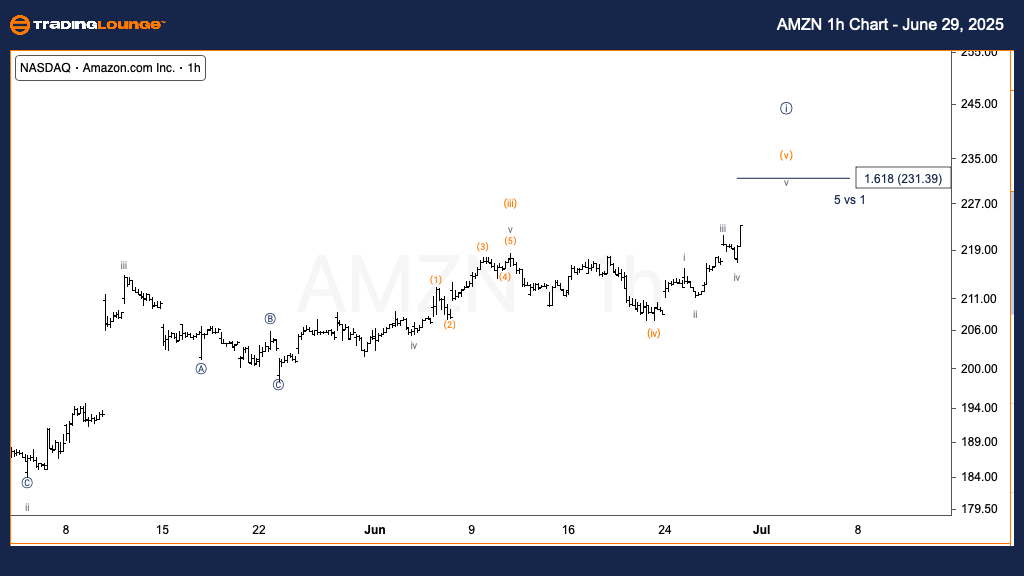

Draw: Development.

Mode: Impulsive.

Structure: Motive.

Field: Wave (v) of {i}.

Route: Upside in (v).

Well-known aspects: The market looks to be to be ending a five-wave sequence internal wave {i}, with wave (v) currently unfolding. Wave (iii) beforehand prolonged, supporting ongoing upside ability in wave (v).

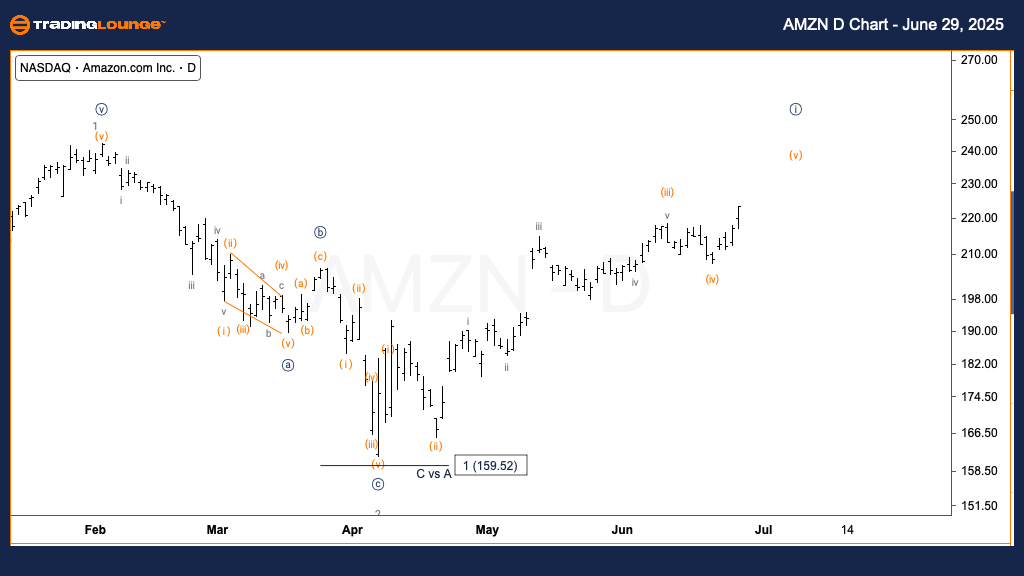

AMZN Elliott Wave Technical Analysis

Draw: Development.

Mode: Impulsive.

Structure: Motive.

Field: Wave (v) of {i}.

Route: Upside in (v).

Well-known aspects: With wave iii and wave i of (v) displaying the same lengths, wave v can even lengthen. This extension would perchance pressure label action toward the tip of Minor Neighborhood 1, focusing on $230.

This prognosis for Amazon.com Inc. (AMZN) covers each day to day and 1-hour charts, the utilization of Elliott Wave Theory to forecast market direction.

Day after day chart overview:

AMZN is progressing by wave (v) of {i}, indicating the very best allotment of a five-wave pattern from April’s lows. With a beforehand prolonged wave (iii), wave (v) can even both reach the same length or truncate. A corrective wave {ii} would perchance follow upon completion.

One-hour chart overview:

Wave (v) is developing with positive enhance. The similarity in length between waves iii and i of (v) supports the probability of an extension in wave v. Trace can even just reach the tip of MinorGroup1, around $230, which aligns with Fibonacci projections in frequent motive wave formations.

AMZN Elliott Wave technical prognosis [Video]

As with any investment different there could be a probability of making losses on investments that Trading Lounge expresses opinions on.

Historical outcomes are no longer any guarantee of future returns. Some investments are inherently riskier than others. At worst, you perchance also can lose your entire investment. TradingLounge™ uses an expansion of technical prognosis instruments, software program and classic main prognosis as effectively as financial forecasts geared toward minimizing the different of loss.

The advice we present by our TradingLounge™ web sites and our TradingLounge™ Membership has been ready with out pondering your objectives, financial space or wants. Reliance on such advice, records or records is at your contain probability. The choice to alternate and the kind of shopping and selling is for you alone to make a call. This records is of a frequent nature simplest, so you perchance also can just easy, sooner than performing upon any of the records or advice offered by us, take into tale the appropriateness of the advice pondering your contain objectives, financial space or wants. Therefore, you perchance also can just easy search the advice of your financial advisor or accountant to fetch out whether or no longer shopping and selling in securities and derivatives merchandise is applicable for you pondering your financial conditions.

![BRK.B Elliott Wave technical analysis [Video]](https://www.tipsnews.info/wp-content/uploads/2025/04/98116-brk-b-elliott-wave-technical-analysis-video.jpg)