USD/INR drops further amid caution ahead of Fed’s monetary policy

The Indian Rupee (INR) rises additional against the US Dollar (USD) on Wednesday. The USD/INR pair falls to discontinuance to 90.00 as the Indian Rupee positive aspects additional, with the origin of two-day replace talks between the United States (US) and India on Wednesday. US Deputy Alternate Consultant Rick Switzer changed into scheduled to focus on over with India on December 10-11, whereas India’s distant places ministry described Switzer’s conferences as a “familiarisation” recede, Reuters reported.

Officers from India would take a look at out to push for reducing tariffs on exports to the US, which currently stands at 50%, definitely one of the last notice amongst Washington’s procuring and selling partners.

Signs from the meeting that the US and India have made development in the direction of reaching a consensus would be favorable for the Indian Rupee, which has lost valuable hobby from distant places merchants as a result of replace deal uncertainty.

To this level in December, International Institutional Patrons (FIIs) have grew to alter into out to be win sellers on all procuring and selling days, and have offloaded stake payment Rs. 14,819.29 crores. FIIs have also remained win sellers in the final five months.

On the home front, merchants will heart of attention on the retail User Label Index (CPI) data for November, that shall be released on Friday. Based mostly on a December 4-8 Reuters ballot, India’s retail inflation grew at an annualized tempo of 0.7%, quicker than 0.25% in October.

Day to day digest market movers: The Fed is expected to diminish hobby rates by 25 bps to a pair.50%-3.75%.

- A additional restoration in the Indian Rupee against the US Dollar is also driven by caution amongst merchants sooner than the Federal Reserve’s (Fed) monetary policy, that shall be announced at 19:00 GMT.

- As of writing, the US Dollar Index (DXY), which gauges the Dollar’s value against six principal currencies, ticks down to discontinuance to ninety nine.20

- The CME FedWatch software program presentations that the probability of the Fed reducing hobby rates by 25 foundation parts (bps) to a pair.50%-3.75% in the December policy meeting is 87.6%. This could per chance per chance very effectively be the third hobby payment decrease by the Fed in a row. Firm Fed dovish expectations are driven by inclined United States (US) labour market prerequisites.

- Recently, a valuable choice of Federal Originate Market Committee (FOMC) individuals also supported the need of additional policy expansion amid blueprint back employment risks. In leisurely November, Fresh York Fed Monetary institution President John Williams talked about that there could be room for additional hobby payment cuts in the discontinuance to term as the policy is restful modestly restrictive, whereas warning that the “economic development has slowed and the labour market has step by step cooled”.

- Because the Fed is form of clear to divulge borrowing rates down additional, the principal driver for the US Dollar’s outlook shall be Fed’s steerage on hobby rates. Patrons would desire to know whether the Fed will issue a pause to the continued monetary-easing advertising and marketing campaign or lean in the direction of a data-dependent design.

- Monetary market contributors will also heart of attention on the Fed’s dot scheme, which presentations where policymakers collectively peep the Federal Funds Price heading in the discontinuance to-to-long tear.

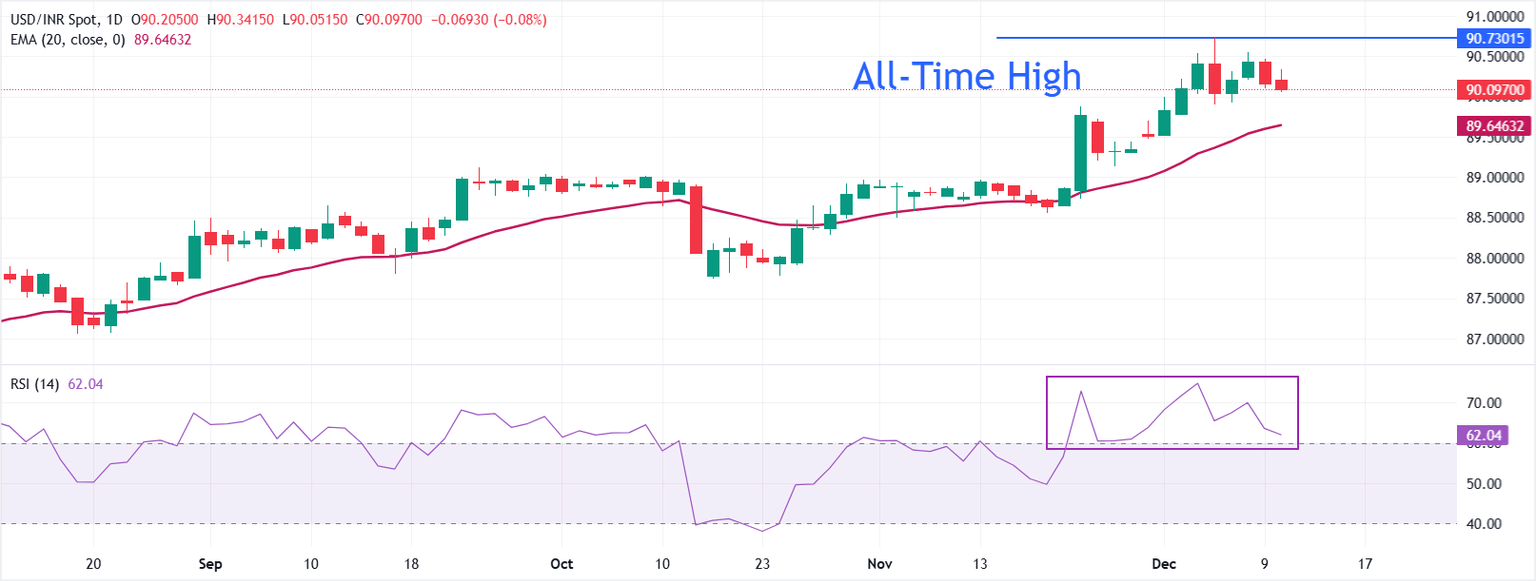

Technical Diagnosis: USD/INR remains above 20-day EMA

USD/INR trades discontinuance to 90.00 in the opening session on Wednesday. The upward-sloping 20-day Exponential Transferring Sensible (EMA) at 89.6463 underscores an on a fashioned foundation uptrend, with the verbalize conserving above it.

The 14-day Relative Power Index (RSI) at 62 has eased from earlier overbought readings, indicating firm yet moderating momentum.

Pattern power would remain in space whereas label stays above the 20-day EMA, where pullbacks could per chance per chance discover toughen. A renewed push in momentum in the direction of the RSI 70.00 band could per chance per chance lengthen positive aspects, whereas a drop in the direction of 50.00 would signal consolidation. Patrons defending the 20-day EMA would receive the direction greater intact, whereas a discontinuance below it could per chance well also originate a deeper correction in the direction of the November 13 excessive at 88.97.

(The technical diagnosis of this story changed into written with the wait on of an AI software program)

Economic Indicator

Fed Hobby Price Possibility

The Federal Reserve (Fed) deliberates on monetary policy and makes a resolution on hobby rates at eight pre-scheduled conferences per year. It has two mandates: to receive inflation at 2%, and to like elephantine employment. Its principal software program for achieving right here is by atmosphere hobby rates – both at which it lends to banks and banks lend to at least one one more. If it decides to hike rates, the US Dollar (USD) tends to toughen because it attracts more distant places capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering greater returns. If rates are left unchanged, attention turns to the tone of the Federal Originate Market Committee (FOMC) commentary, and whether it is hawkish (expectant of greater future hobby rates), or dovish (expectant of decrease future rates).

Learn more.

Next release:

Wed Dec 10, 2025 19:00

Frequency:

Irregular

Consensus:

3.75%

Previous:

4%

Source:

Federal Reserve